Lerato Molefe has completed her first year in business as a general dealer and her bookkeeper produced

Question:

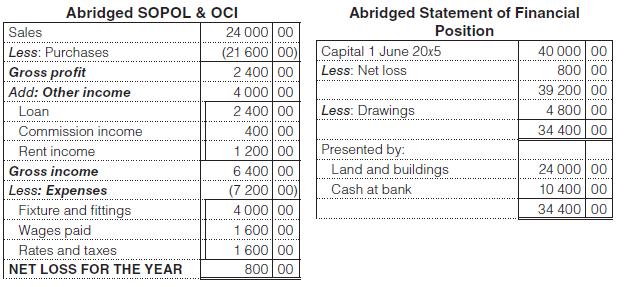

Lerato Molefe has completed her first year in business as a general dealer and her bookkeeper produced these abridged annual financial statements:

Lerato Molefe was surprised to discover that she had made a loss and asked her accountant friend to look into the situation for her. The accountant discovered that:

1 The bookkeeper had only recorded double-entries for cash received and cash paid out during the year. However, whenever there had been purchases or sales on credit he had kept a record of these in ‘unpaid invoices’ files that he transferred to ‘invoices settled’ files when the debts were subsequently paid. At 31 May, unpaid accounts receivable totalled R2 000 and unpaid accounts payable R1 200.

2. The inventory count showed that the cost of inventory on hand at 31 May 20x6 was R5 200.

3. During the year, Lerato had taken inventory that cost R400 for her personal use and this had not been recorded.

4. On the last day of the financial year, Lerato had borrowed R2 400 for the business for a 5-year period at 6% per annum, in terms of a mortgage over the land and buildings.

5. Commissions earned, but not received at 31 May 20x6, totalled R160 and on the same date R240 of the rent received was paid in advance.

6. Fixtures and fittings were bought on 1 June 20x5 and should be depreciated by 10% per annum.

7. Wages owing at 31 May totalled R200, and R440 of the rates paid relate to 20x7.

You are required to:

Prepare adjusting entries in general journal form to record adjustments 1 to 7. If an adjusting entry is not required, note your opinion and give reasons for it.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit