Longhorn Company (70% WI) and Aggie Company (30% WI) own a joint working interest in the Dowling

Question:

Longhorn Company (70% WI) and Aggie Company (30% WI) own a joint working interest in the Dowling Field. There is a 1/8 royalty owner. The 1/8 royalty is shared proportionally by Longhorn and Aggie. Longhorn and Aggie agree that Longhorn’s purchaser will take March’s gas production and Aggie’s purchaser will take April’s production. Gas allocations will be equalized in May.

Ignore severance taxes.

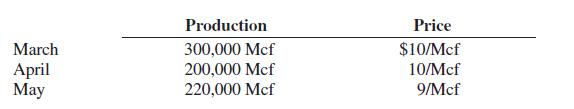

Gross production and gas prices were as follows:

Each working interest owner receives payment only for gas delivered to his purchaser.

REQUIRED:

a. Prepare a gas balance report.

b. Prepare entries for the three-month period for both parties assuming both companies use the entitlement method for both revenue and royalty.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: