Lumber Enterprises had these balances on 1 April 20x7: Transactions for April (VAT at 14%): 5 Bought

Question:

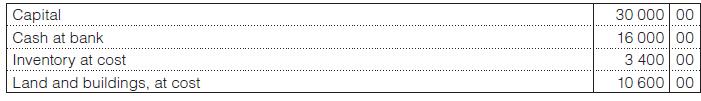

Lumber Enterprises had these balances on 1 April 20x7:

Transactions for April (VAT at 14%):

5 Bought goods on credit from Hardware Suppliers for R6 840.

7 Cash sales, R9 348.

10 Bought goods on credit from Meadow Ridge Timbers for R2 964.

13 Returned unsatisfactory system to Hardware Suppliers, R684 (VAT incl.).

15 Cash sales, R3 990.

17 The owner took goods that had cost R200 (VAT excl.) for his own use.

20 Refunded R45,60 by cheque for goods returned by a dissatisfied customer.

25 Bought goods on credit from Timber Town, R1 026.

A physical system count after the close of business on 30 April established that the cost of unsold system on hand was R2 450.

You are required to:

1. Open ledger accounts and enter the balances and capital as on 1 April 20x7.

2. Record the transactions for the month in the ledger accounts.

3. Extract a pre-adjustment trial balance.

4. Prepare the trading account for the month ended 31 April 20x7 and a statement of financial position at that date.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit