Lynch Co. provides various fringe benefits for its three employees. It provides vacation and personal leave at

Question:

Lynch Co. provides various fringe benefits for its three employees. It provides vacation and personal leave at the rate of one day for each month worked. Its employees earn a combined total of approximately \(\$ 600\) per day. In addition, Lynch Co. pays \(\$ 750\) per month in medical insurance premiums for its employees. Lynch also contributes \(\$ 300\) per month into a retirement plan for the employees. Assume the Social Security tax rate is \(6 \%\) of the first \(\$ 110,000\) of salaries and the Medicare tax rate is \(1.5 \%\). The unemployment tax rate is \(5.2 \%\) on the first \(\$ 7,000\) of earnings per employee.

Required

a. Prepare the monthly journal entry for the accrued fringe benefits.

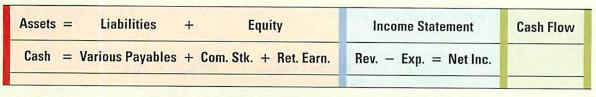

b. Show the effect of the above transaction on a statements model like the one shown below.

c. If the three employees each worked 250 days for the year, what is Lynch Co.'s total payroll cost (salary, payroll taxes, and fringe benefits) for the year? (Assume that each employee earns \(\$ 200\) per day.)

Step by Step Answer: