On 1 January 20x4, Fedoc Distributors had these accounts (among others) in their books: Their accounting policies

Question:

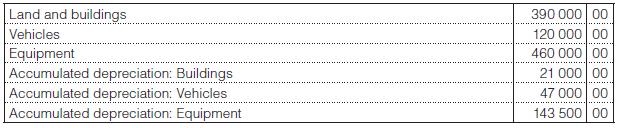

On 1 January 20x4, Fedoc Distributors had these accounts (among others) in their books:

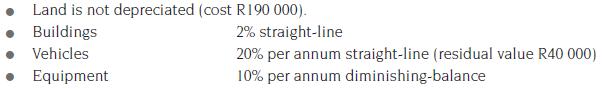

Their accounting policies for depreciation are:

During the year, these transactions relating to non-current assets took place:

1 Jan. Bought a new vehicle for R30 000 cash. The vehicle had a residual value of R10 000.

1 Jun. Bought equipment on credit from Quip Ltd for R18 000.

You are required to:

1. Prepare the journal entries to record the purchase of the new assets.

2. Prepare the journal entries to record depreciation at the end of the 20x4 financial year.

3. Prepare the journal entries to record the closing transfers at the end of the 20x4 financial year.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit