Peter and Paul are partners, sharing profits and losses in the ratio of 2 : 1. On

Question:

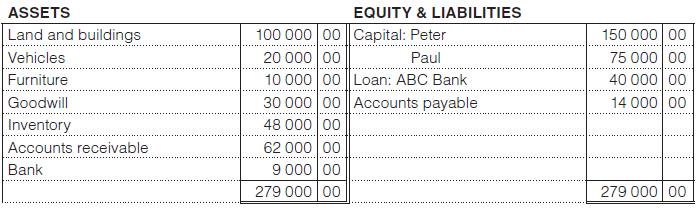

Peter and Paul are partners, sharing profits and losses in the ratio of 2 : 1. On 30 June 20x5, their abridged statement of financial position was: (Ignore VAT.)

On 1 July 20x5, they decided to admit Gavin as a partner on these terms and conditions:

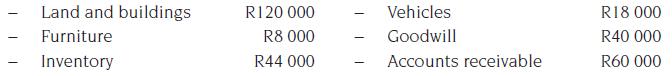

1. Assets were to be revalued as:

2. Gavin must make a one-fifth cash contribution share in the partnership’s profit and losses.

3. Peter and Paul would, from today, share profits and losses in the ratio of 3 : 2 and must pay in or withdraw cash to bring their capital balances into the profit-sharing proportion based on Gavin’s capital.

4. Goodwill must not be shown as an asset in the statement of financial position of the new partnership.

You are required to:

1. Journalise all the transactions for the events that took place to admit Gavin to the partnership.

2. Draw up the statement of financial position (in T-form) of the new partnership immediately after admitting Gavin.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit