Record the transactions of Joan Arendse in Question 6.8 into the general journal. Data from Question 6.8.

Question:

Record the transactions of Joan Arendse in Question 6.8 into the general journal.

Data from Question 6.8.

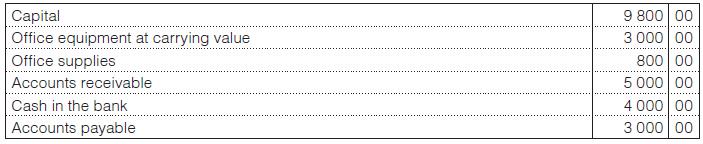

On 1 March, Joan Arendse (an accounting consultant) had these assets and liabilities:

Transactions for March:

1 Paid March rent by cheque R200.

2 Purchased office supplies costing R250 on credit. Treated as an asset at acquisition date.

11 Purchased additional equipment for R1 400, paying R800 by cheque with the balance on account.

13 Received R4 500 from accounts receivable and banked this sum.

17 Joan paid R500, that she had won in a competition, into her business bank account.

19 Paid accounts payable by cheque, R1 600.

24 Joan cashed a cheque for R300 for her personal use.

25 Charged bookkeeping fees to clients, R1 200.

31 Paid wages for the month by cheque R150.

31 Depreciation on office equipment is estimated to be R100.

31 After the inventory count, it was found that the cost of office supplies used was R320.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit