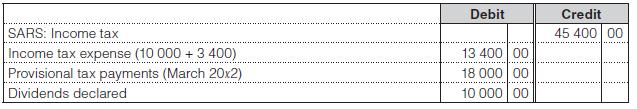

The trial balance of Daphne (Pty) Ltd as at 30 September 20x2 included these accounts: Additional information:

Question:

The trial balance of Daphne (Pty) Ltd as at 30 September 20x2 included these accounts:

Additional information:

1. The profit before tax figure for the year ended 30 September 20x2 is R68 000. The taxable income figure is R150 000. Income tax is payable at 30% and dividend tax at 15%.

2 The provisional payment for September 20x2 of R10 000 was incorrectly posted to the income tax expense account.

3 Foreign tax of R3 400 was paid in August 20x2.

4 The last income assessment received for 30 September 20x0 of R38 000 was fully paid in August 20x2. The actual provision for income tax was R42 400. The income tax assessment for 30 September 20x1 is still outstanding.

5 Included in the SARS provision for income tax is a liability of R8 000, which has been in dispute since 19x9. The dispute was resolved in the current year when the company agreed to pay R6 800.

6. No dividends were received.

You are required to:

1. Prepare journal entries to record any adjustments that may be necessary to take the above information into account. (Narrations are not required.)

2. What is the minimum amount to be paid in the third provisional payment on 31 March 20x3 to avoid incurring penalties.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit