These balances appeared, among others, in the accounting records of Fuchs Stores on 1 December 20x1: (Ignore

Question:

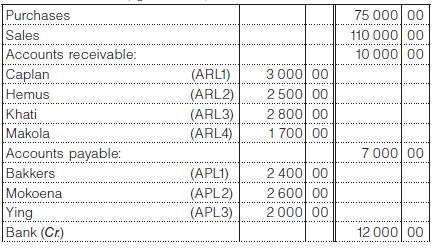

These balances appeared, among others, in the accounting records of Fuchs Stores on 1 December 20x1: (Ignore VAT)

Transactions for December 20x1:

1 Purchased merchandise on account from Bakkers and received invoice F216, R1 700.

3 Purchased merchandise on account from Mokoena and received invoice 524, R2 000.

7 Sold goods on account to:

– Hemus (invoice 2049) for R800.

– Khati (invoice 2050) for R1 100.

– Makola (invoice 2051) for R2 300.

10 Paid Bakkers, R1 900 (cheque 1423).

Paid Mokoena, R2 000 (cheque 1424). Paid Ying, R1 500 (cheque 1425).

20 Received the following amounts:

– Caplan (receipt R1707) for R600.

– Hemus (receipt R1708) for R1 700.

– Khati (receipt R1709) for R1 500.

– Makola (receipt R1710) for R1 700.

You are required to:

1 Record the transactions for December 20x1 in the appropriate subsidiary journals.

2 Post the journals to the subsidiary ledgers and the general ledger. Then balance the accounts.

3 Prepare a list of accounts receivable outstanding from the accounts receivable ledger. Does your list agree with the accounts receivable account in the general ledger?

4 Prepare a list of accounts payable outstanding from the accounts payable ledger. Does your list agree with the accounts payable account in the general ledger?

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit