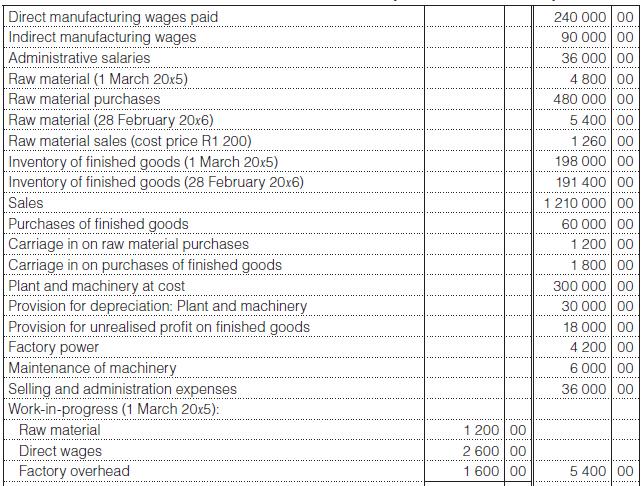

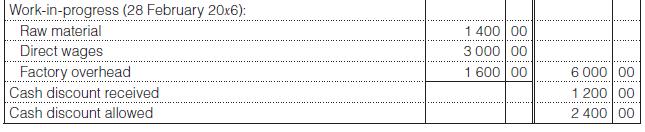

This information is from the books of Tools Ltd for the year ended 28 February 20x6: Additional

Question:

This information is from the books of Tools Ltd for the year ended 28 February 20x6:

Additional information:

• Provide for depreciation on plant and machinery at the rate of 10% per annum on cost.

• Finished goods are transferred to the sales department at cost of manufacture plus 10% and the finished goods above were valued on this basis. Final inventory of finished goods consists of manufactured goods only, as all purchased finished goods are sold.

You are required to:

You are required to draft the statement of the cost of goods manufactured and statement of profit or loss & other comprehensive income for the year ended 28 February 20x6, clearly showing the following:

1. Cost of raw material consumed.

2. Cost of manufacture.

3. Profit on manufacture.

4. Cost of sales.

5. Gross profit.

6. Net profit before taxation.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit