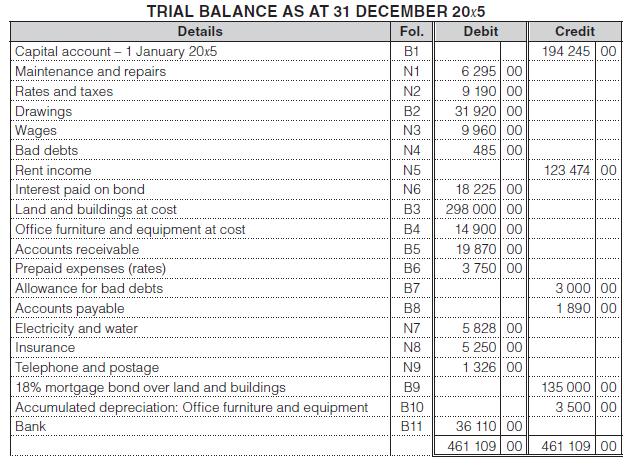

This trial balance is for High Flats (owned by Mr Cook) as at 31 December 20x5. Additional

Question:

This trial balance is for High Flats (owned by Mr Cook) as at 31 December 20x5.

Additional information:

1. Office furniture and equipment must be depreciated at 15% per annum on the diminishing-balance method. (No furniture or equipment was bought or sold during the year.)

2. The mortgage is for a fixed term of 20 years. No capital repayment is required until 20x5.

3. Insurance includes an amount of R250 for Mr Cook’s private house.

4. The payment in advance (rates and taxes) shown in the trial balance is for the previous financial year. The prepayment of R4 500 for the current year is included in the rates and taxes figure of R9 190.

5. It is considered that an allowance for bad debts of R2 000 would be adequate.

6. An annual salary of R650 paid to the bookkeeper was debited to drawings in error.

7. A receivable, whose outstanding balance of R480 is considered to be irrecoverable, is to have the debt written off.

You are required to:

1. Prepare the necessary adjusting journal entries for the adjustments.

2. Calculate the net profit or loss.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit