Thomas Petroleum has the following information: The lease is subleased to Stevenson Oil Corporation for $300,000, and

Question:

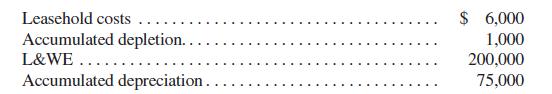

Thomas Petroleum has the following information:

The lease is subleased to Stevenson Oil Corporation for $300,000, and Thomas retains an 1/16 ORI. At the date of the sublease, the FMV of the equipment is $180,000.

REQUIRED: Determine the tax basis of Thomas’ and Stevenson’s assets and the amount of any taxable income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: