Total Onslaught (Pty) Ltd is a small company which (because of its aggressive advertising campaigns) has a

Question:

Total Onslaught (Pty) Ltd is a small company which (because of its aggressive advertising campaigns) has a significant profile. The company manufactures gas-filled hot air balloons.

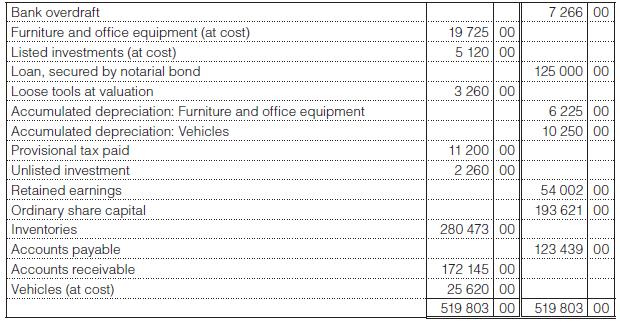

On 31 December 20x6 (financial year end), this information was extracted from its books:

After most of the closing entries had been passed, you learn that:

• The listed investments were bought for speculative purposes. Dividends for the year amounted to R400. (Dividends on share investments are exempt from tax.)

• The retained earnings at the beginning of the year amounted to R25 602 and was posted to accounts receivable.

• An interim dividend of R5 000 was declared and paid on 1 October 20x6 and a final dividend of R5 000 was declared on 30 December 20x6. This dividend was paid on 18 January 20x7, but no entries to record it had been made before the trial balance was extracted.

• South African normal tax is to be calculated at the rate of 40c in the R1 on the trading profit which (excluding dividends) is the same as the taxable income.(Ignore dividend tax.)

• The loan of R125 000 is to be repaid in five years’ time.

You are required to:

1. Prepare the statement of financial position and the statement of changes in equity, without giving the amounts unless they are calculable from the information.

2. Prepare any other notes that you would expect from the information above, to be attached to the statement of financial position and statement of changes in equity. (Comparative figures are not required.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit