Wildcat Oil Company began operations on 1/5/2021 and has acquired only two properties. The two properties, which

Question:

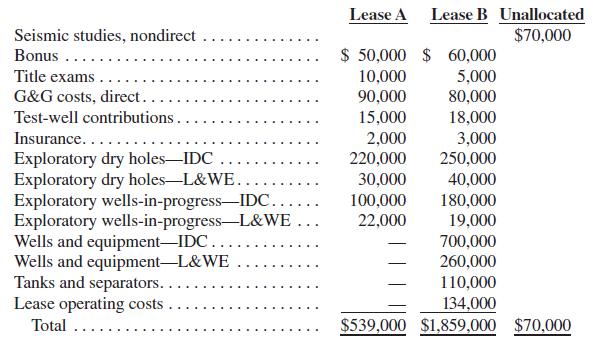

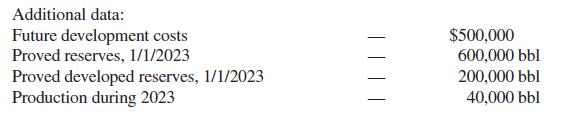

Wildcat Oil Company began operations on 1/5/2021 and has acquired only two properties. The two properties, which are both considered significant, are located in different states. Lease B was proved on 1/1/2023. Costs incurred from 1/5/2021 through 12/31/2023 are as follows:

Other information:

The company also owns a building that it purchased 1/1/2021 at a cost of $500,000. The building houses the corporate headquarters and has an estimated life of 20 years (ignore salvage). The operations conducted in the building are general in nature and are not directly attributable to any specific exploration, development, or production activities. Since the building is not related to exploration, development, or production, it is depreciated using straight-line depreciation for financial accounting.

REQUIRED:

a. Give the entry to record DD&A for 2023 under full cost accounting, assuming all possible costs are excluded from amortization.

b. Give the entry to record DD&A for 2023 under successful efforts accounting.

Step by Step Answer: