Alliance Pipeline Limited Partnership is a limited partnership that owns and operates a natural gas pipeline in

Question:

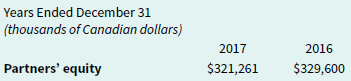

Alliance Pipeline Limited Partnership is a limited partnership that owns and operates a natural gas pipeline in Alberta. The balance sheet and notes to its financial statements include the following excerpts:

General Business Description

Alliance is managed by Alliance Pipeline Ltd. (General Partner). The General Partner was established on April 17, 1997, and continues to operate under the federal laws of Canada. The General Partner is allocated 1% of net income or loss, and undistributed income of Alliance with the remaining 99% being allocated equally between an affiliate of Enbridge Inc. and an affiliate of Pembina Pipeline Corporation (Partners).

The General Partner?s sole activity is managing the business and affairs of Alliance. The rights, powers, duties, and obligations of the General Partner are set out in Alliance?s Limited Partnership Agreement dated as of December 31, 1998, as amended.

Instructions

What are the advantages to the company of operating as a limited partnership rather than as a general partnership?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak