Ben Conway, Ida Chan, and Clair Scott formed CCS Consulting by making capital contributions of $245,000, $280,000,

Question:

Ben Conway, Ida Chan, and Clair Scott formed CCS Consulting by making capital contributions of $245,000, $280,000, and $175,000, respectively. They anticipate annual profit of $360,000 and are considering the following alternative plans of sharing profits and losses:

a. Equally;

b. In the ratio of their initial investments; or

c. Salary allowances of $110,000 to Conway, $85,000 to Chan, and $60,000 to Scott and interest allowances of 12% on initial investments, with any remaining balance shared equally.

Required

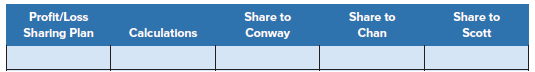

1. Prepare a schedule with the following column headings:

Use the schedule to show how a profit of $360,000 would be distributed under each of the alternative plans being considered.

2. Prepare a statement of changes in equity showing the allocation of profit to the partners, assuming they agree to use alternative (c) and the profit actually earned for the year ended December 31, 2020, is $360,000. During the year, Conway, Chan, and Scott withdraw $40,000, $30,000, and $20,000, respectively.

3. Prepare the December 31, 2020, journal entry to close Income Summary assuming they agree to use alternative (c) and the profit is $360,000. Also, close the withdrawals accounts.

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann