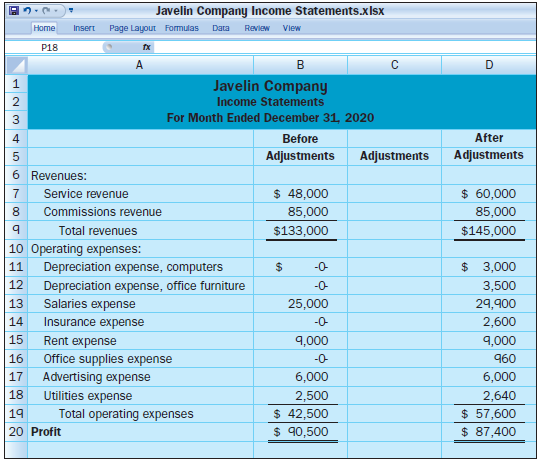

Following are two income statements for Javelin Company for the month ended December 31, 2020. Column B

Question:

Following are two income statements for Javelin Company for the month ended December 31, 2020. Column B was prepared before any adjusting entries were recorded and column D includes the effects of adjusting entries. The company records cash receipts and disbursements related to unearned and prepaid items in balance sheet accounts. Analyze the statements and prepare the adjusting entries that must have been recorded.

Of the $12,000 increase in Revenue, 30% represents additional revenue but not billed. The other 70% was earned by performing services that the customers had paid for in advance.

Analysis Component: Identify and explain which GAAP requires that adjusting entries be recorded. By how much would revenues, expenses, and profit be overstated/understated if adjustments were not recorded at December 31, 2020, for Javelin Company?

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann