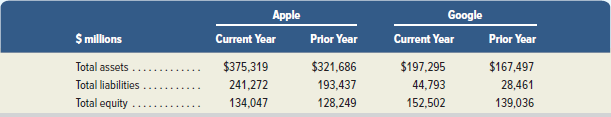

Key figures for Apple and Google follow. Required 1. Compute the debt-to-equity ratios for Apple and Google

Question:

Key figures for Apple and Google follow.

Required

1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year.

2. Use the ratios from part 1 to determine which company’s financing structure is least risky.

3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Apple and (b)Google?

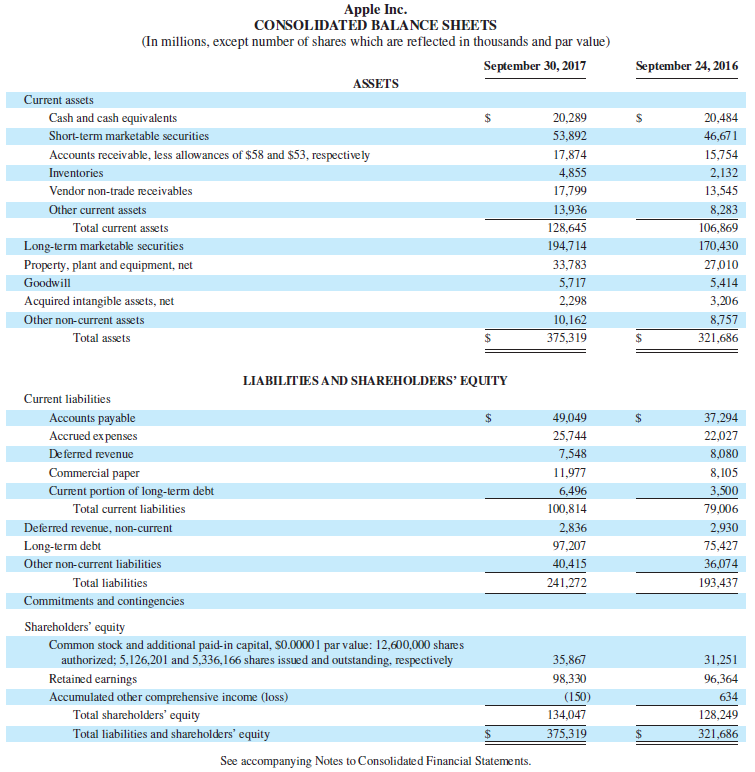

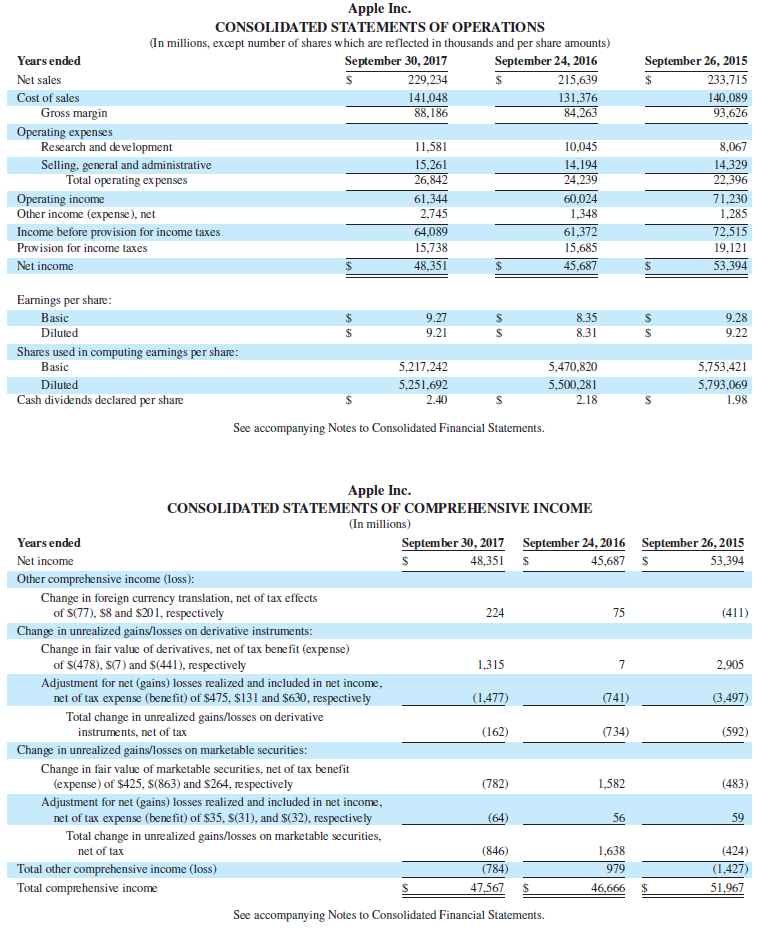

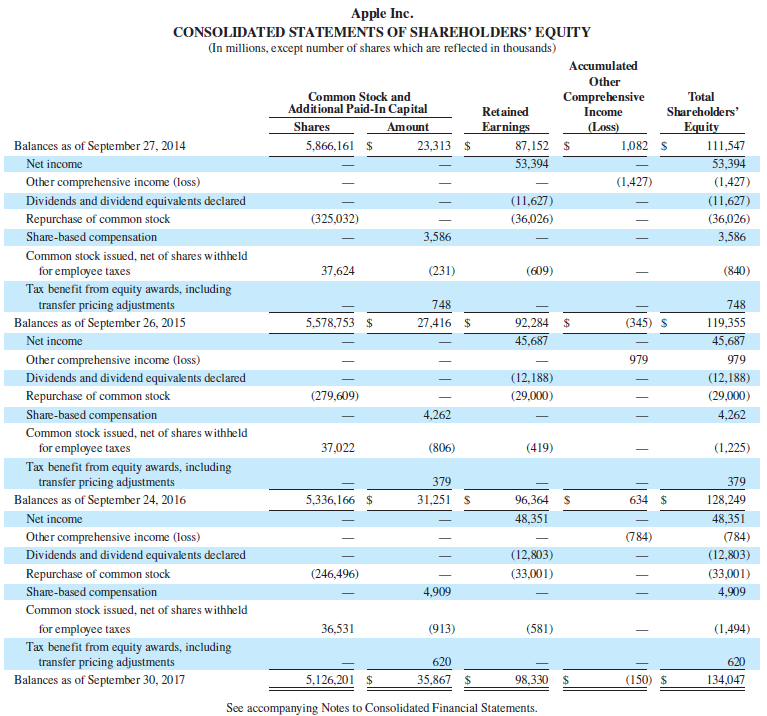

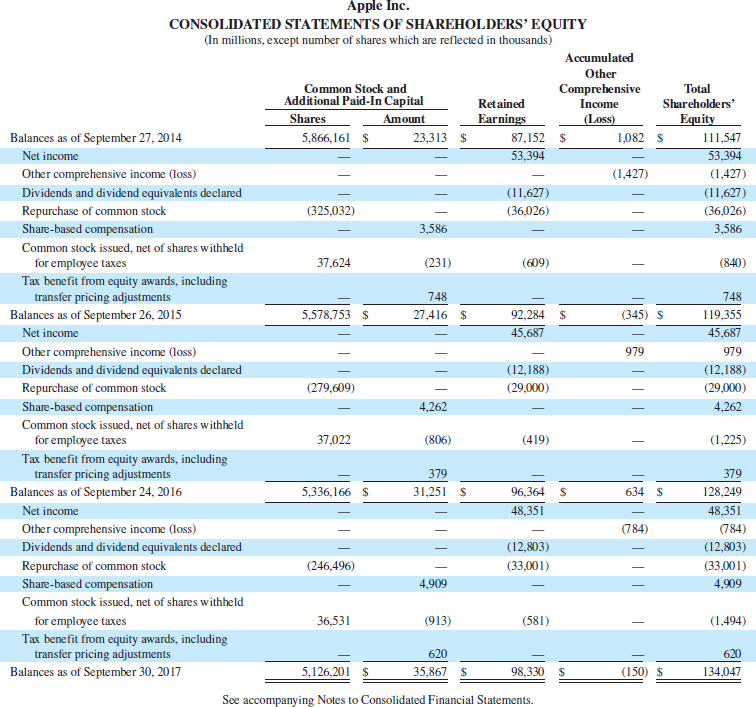

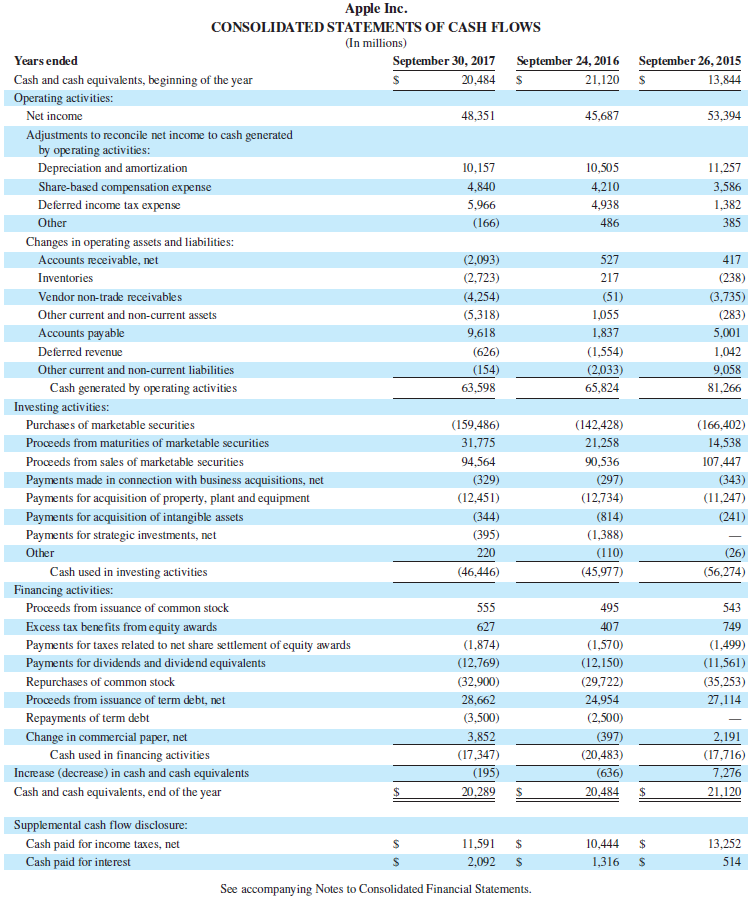

Data from Apple's

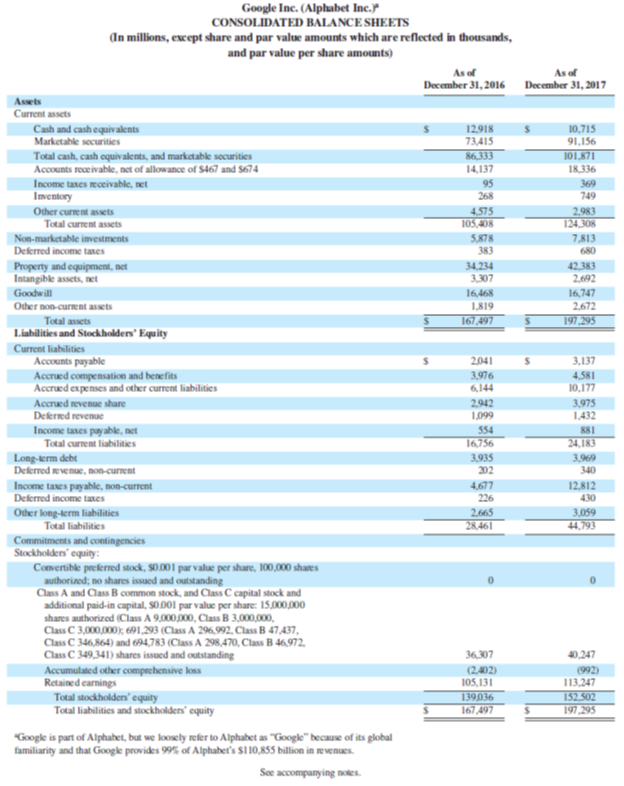

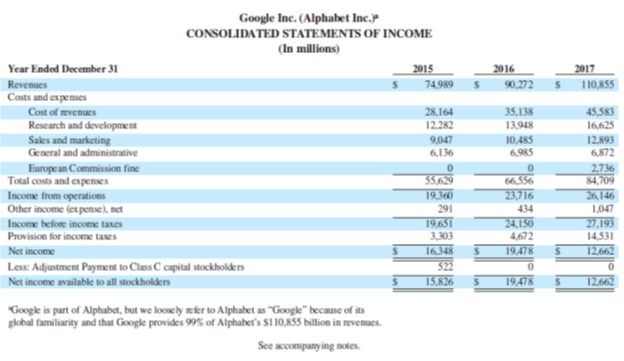

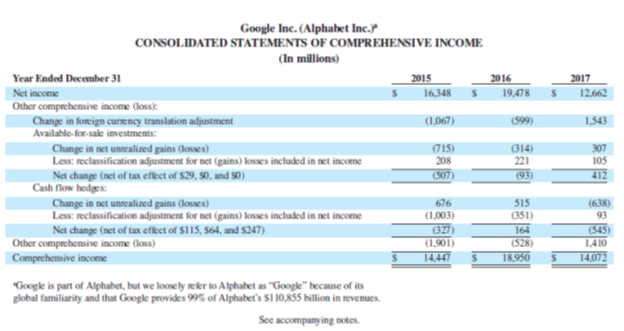

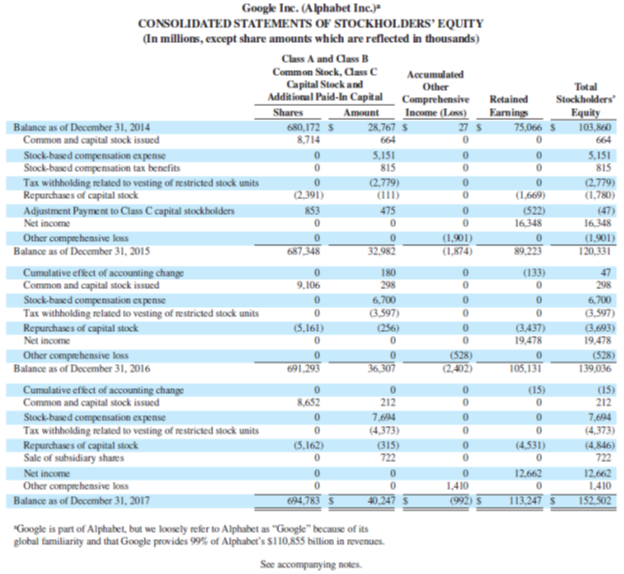

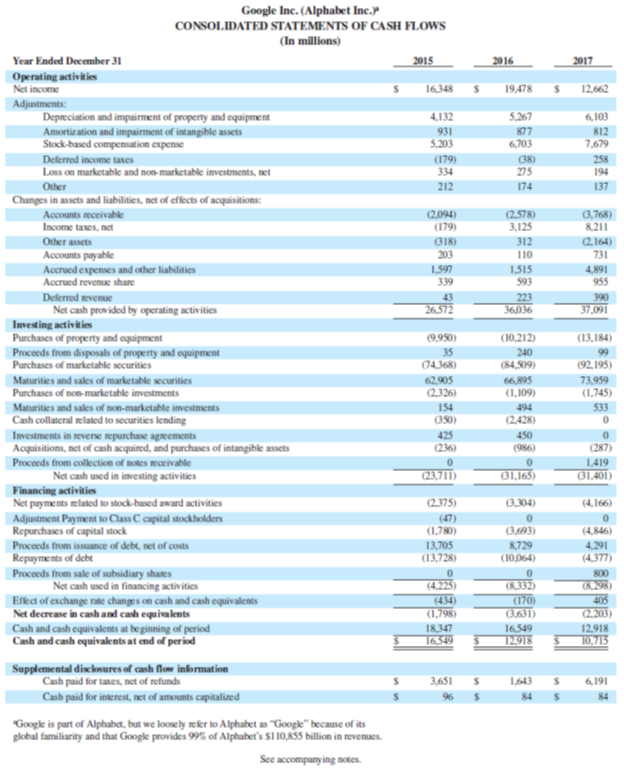

Data from Google's

Transcribed Image Text:

Apple Google Prior Year Current Year Prior Year Current Year $ millions $375,319 241,272 134,047 $321,686 193,437 128,249 $197,295 44,793 152,502 $167,497 28,461 139,036 Total assets Total liabilities Total equity Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 ASSETS Current assets Cash and cash equivalents 24 20,289 20,484 Short-term marketable securities 53,892 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 Total current assets 128,645 106,869 Long-term marketable securities 194,714 170,430 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 Acquired intangible assets, net 2.298 3,206 Other non-current assets 10,162 8,757 Total assets 375,319 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 De ferred revenue 7,548 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 Total current liabilities 100,814 79,006 Deferred revenue, non-current 2,836 2,930 Long-term debt 97,207 75,427 Other non-current liabilities 40,415 36,074 Total liabilities 241,272 193,437 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

millions 1 Apples current year debttoequity ratio 241272 1340...View the full answer

Answered By

Salmon ouma

I am a graduate of Maseno University, I graduated with a second class honors upper division in Business administration. I have assisted many students with their academic work during my years of tutoring. That has helped me build my experience as an academic writer. I am happy to tell you that many students have benefited from my work as a writer since my work is perfect, precise, and always submitted in due time. I am able to work under very minimal or no supervision at all and be able to beat deadlines.

I have high knowledge of essay writing skills. I am also well conversant with formatting styles such as Harvard, APA, MLA, and Chicago. All that combined with my knowledge in methods of data analysis such as regression analysis, hypothesis analysis, inductive approach, and deductive approach have enabled me to assist several college and university students across the world with their academic work such as essays, thesis writing, term paper, research project, and dissertation. I have managed to help students get their work done in good time due to my dedication to writing.

5.00+

4+ Reviews

16+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Break into teams and complete the following requirements related to effective interest amortization for a premium bond. 1. Each team member is to independently prepare a blank table with proper...

-

Accenture purchases 55% of the voting common stock of JBL. After the purchase, Accenture has a controlling influence over JBL. (1) Which method does Accenture use to account for its investment in...

-

Key figures for Apple and Google follow. Required 1. Compute return on total assets for Apple and Google for the two most recent years. 2. Which of these two companies has the better return on total...

-

(a) lim f(x) X-C+ 5. y 7. Y 9. 2 IT - Limits and Continuity In Exercises 5-10, use the graph to determine each limit, and discuss the continuity of the function. -3+ (4,3), + + 1/2 3 4 (3, 1) (b) lim...

-

A copper rod of length 0.50 m and cross-sectional area 6.0 Ã 102 cm2 is connected to an iron rod with the same cross section and length 0.25 m. One end of the copper is immersed in boiling...

-

In Exercises 2536, find the limit (if it exists). If the limit does not exist, explain why. 1 lim (x, y) (0,0) xy 2

-

Johanna Marra and Eric Nazzaro began a romantic relationship in October 2013. That previous July, Nazzarro had purchased a duplex that he intended to renovate. Nazzarro rented out the top floor while...

-

Here are selected 2014 transactions of Cleland Corporation. Jan. 1 Retired a piece of machinery that was purchased on January 1, 2004. The machine cost $62,000 and had a useful life of 10 years with...

-

12. Your calculations show that if the wrong link is shared to a potential Democratic voter, there is a strong chance it could result in them changing their vote to Independent or Republican. If you...

-

What are some factual matters that would be relevant for consequentialist arguments regarding sexual behavior?

-

Use Apples financial statements in Appendix A to answer the following. 1. Identify Apples long-term debt as reported on its balance sheet at (a) September 30, 2017, and (b) September 24, 2016. 2....

-

Selected results from Samsung, Apple, and Google follow. Required 1. Compute Samsungs debt-to-equity ratio for the current year and the prior year. 2. Is Samsungs financing structure more risky or...

-

Smith should conclude that the insurer with the most effi cient underwriting operation is: A . Insurer A. B . Insurer B. C . Insurer C.

-

According to the given information what type of statistical tests were used in this study? and what were the major key findings? Social Workers' Mean Scores on Scales Measuring Attitudes toward...

-

Simplify completely: a) 252x11

-

Use a sum or difference formula or a half angle formula to determine the value of the trigonometric functions. Give exact answers. Do not use decimal numbers. The answer should be a fraction or an...

-

On March 20, a $125 credit memo is given to Garrison Brewer due to merchandise that was the wrong color. The cost of the returned merchandise was $65. If required, round your answers to two decimal...

-

2. A) Formulate mathematically factor duration, clearly defining the terms you use. B) Using the continuous time pricing formula and the chain rule of differentiation to derive mathematically the...

-

On January 1, Espinoza Moving and Storage leased a truck for a four-year period, at which time possession of the truck will revert back to the lessor. Annual lease payments are $10,000 due on...

-

Annual dividends of ATTA Corp grew from $0.96 in 2005 to $1.76 in 2017. What was the annual growth rate?

-

Karim Corp. requires a minimum $8,000 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $8,000 is used...

-

Zisk Co. purchases direct materials on credit. Budgeted purchases are April, $80,000; May, $110,000; and June, $120,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the...

-

Jasper Company has 70% of its sales on credit and 30% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $525,000 for April, $535,000...

-

The risk treatment option of reassigning accountability for a risk to another entity or organization is known as?

-

What are the molecular mechanisms underlying genomic imprinting, and how do parent-of-origin-specific epigenetic marks regulate the expression of imprinted genes during development and beyond?

-

How do leaders vary by the roles they perform and the amount of power they possess?

Study smarter with the SolutionInn App