On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic

Question:

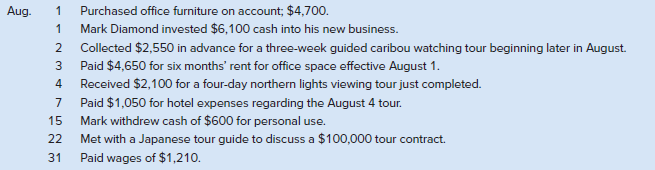

On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations:

Required

1. Prepare general journal entries to record the August transactions.

2. Set up the following T-accounts: Cash (101); Prepaid Rent (131); Office Furniture (161); Accumulated Depreciation, Office Furniture (162); Accounts Payable (201); Unearned Revenue (233); Mark Diamond, Capital (301); Mark Diamond, Withdrawals (302); Revenue (401); Depreciation Expense, Office Furniture (602); Wages Expense (623); Rent Expense (640); Telephone Expense (688); and Hotel Expenses (696).

3. Post the entries to the accounts; calculate the ending balance in each account.

4. Prepare an unadjusted trial balance at August 31, 2020.

5. Use the following information to prepare and post adjusting entries on August 31:

a. The office furniture has an estimated life of three years and a $272 residual value. Use the straight-line method to depreciate the furniture.

b. Two-thirds of the August 2 advance has been earned.

c. One month of the Prepaid Rent has been used.

d. The August telephone bill was not received as of August 31 but amounted to $230.

6. Prepare an adjusted trial balance.

7. Prepare an income statement, a statement of changes in equity, and a balance sheet.

Analysis Component: When a company shows revenue on its income statement, does this mean that cash equal to revenues was received during the period in which the revenues were reported?

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann