On August 26, 2018, Race World International purchased a piece of equipment for a total of $426,000.

Question:

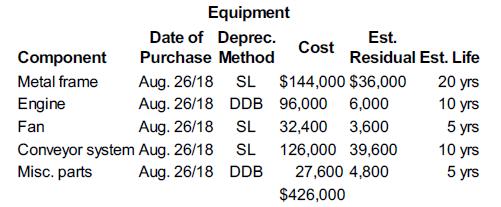

On August 26, 2018, Race World International purchased a piece of equipment for a total of $426,000. The PPE subledger shows the following information regarding the equipment:

Early in 2023, it was determined that the useful life of the metal frame should be adjusted to a remaining life of 20 years with a reduction of $12,000 in the residual value. On October 3, 2023, the company paid $36,000 cash for a new fan to replace the old one, which was sold on the same day to a competitor for $8,400 cash. The new fan had an estimated useful life of five years and a residual value of $4,800.

Required

1. Record the appropriate entries regarding the:

1. Purchase of the replacement fan on October 3, 2023, and sale of the old fan.

2. Depreciation on the equipment on December 31, 2023, the company’s year-end.

2. Calculate total depreciation taken on the equipment for Race World’s year ended December 31, 2023.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris