On December 31, 2017, Toro Companys Allowance for Doubtful Accounts had an unadjusted credit bal- ance of

Question:

Required

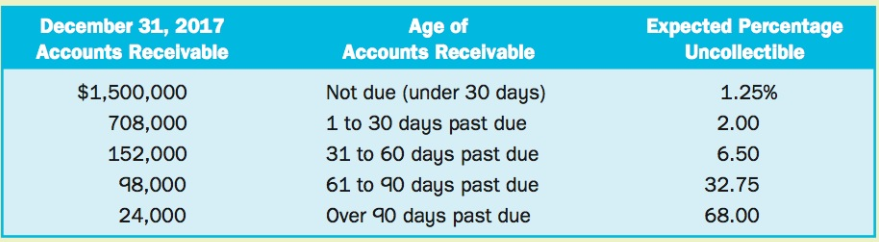

1. Calculate the amount that should appear in the December 31, 2017, balance sheet as the allowance for doubtful accounts.

2. Prepare the journal entry to record bad debt expense for 2017.

Analysis Component: On June 30, 2018, Toro Company concluded that a customer€™s $7,500 receivable (created in 2017) was uncollectible and that the account should be written off. What effect will this action have on Toro€™s 2018 profit? Explain your answer.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: