Paper Planet sells office supplies to a variety of customers. The owner, Matthew Demetri, is trying to

Question:

Paper Planet sells office supplies to a variety of customers. The owner, Matthew Demetri, is trying to decide whether to use the contract-based or earnings approach for revenue recognition. The company is not publicly traded now but the owner is considering it in the near future. Mr. Demetri indicated that the company?s return policy is 30 days from the date of sale and based on previous transactions, he estimated that returns are 20% of sales on average. The company currently uses a perpetual inventory system with the contract-based approach. He has asked you to review the following transactions for the month of April and prepare a comparison of the journal entries required using each approach.

Apr. 3 Sold $3,800 of merchandise to Grand Office Supplies, terms, n/30. The goods cost Paper Planet $2,280.

8 Sold $2,600 of merchandise to Simon Paper Supply, terms n/30. The goods cost $1,560.

10 Grand Offi ce returned $400 of goods for credit because it miscalculated what it needed.

The cost of these goods to Paper Planet was $240.

13 Received amount owing from Grand Office Supplies.

16 Sold $9,000 of merchandise that cost $5,400 to PriceCo., terms n/30.

Apr. 18 Received amount owing from Simon Paper Supply.

24 PriceCo returned $1,800 of the goods purchased on April 16 because they were damaged.

The goods cost Paper Planet $1,080. The merchandise could not be resold and was sent to the recyclers.

Instructions

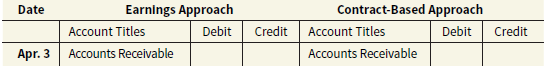

a. Using a table similar to the one below, prepare journal entries for the above transactions using the contract-based and earnings approaches to revenue recognition. The first journal entry has been partially completed.

b. Prepare a brief memo to Mr. Demitri that describes the main differences between the two approaches and discuss the purpose of recording estimated returns at the time of sale.

Mr. Demitri is concerned about the amount of returns the company has. Provide a list of possible reasons for the amount of returns and make suggestions on how the company can reduce the amount for future estimates.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak