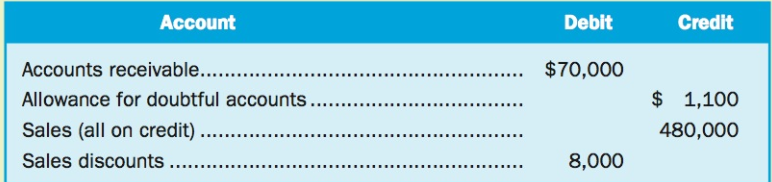

Selected unadjusted account balances at December 31, 2017, are shown below for Demron Servicing. Required a. Demron

Question:

Required

a. Demron estimates that 1.5% of net credit sales will prove to be uncollectible. Prepare the adjusting entry required on December 31, 2017, to estimate uncollectible receivables.

b. During 2018, credit sales were $620,000 (cost of sales $406,500); sales discounts of $12,000 were taken when accounts receivable of $440,000 were collected; and accounts written off during the year totalled $10,000. Prepare the entries for these transactions.

c. Record the adjusting entry required on December 31, 2018, to estimate uncollectible receivables, assuming it is based on 1.5% of net credit sales.

d. Show how accounts receivable would appear on the December 31, 2018, balance sheet. Analysis Component: Comment on the advantages and disadvantages of using the income statement approach for estimating uncollectibles.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann