Shek Enterprises is owned by Memphis Shek and has a December 31 fiscal year end. The company

Question:

Shek Enterprises is owned by Memphis Shek and has a December 31 fiscal year end. The company prepares adjusting entries on an annual basis. Some additional information follows:

1. A one-year insurance policy was purchased on May 1, 2021.

2. A count of supplies on December 31, 2021, shows $1,290 of supplies on hand.

3. The equipment has an estimated useful life of six years.

4. An analysis of the Unearned Revenue account shows that $1,550 remains unearned at December 31, 2021.

5. The three-year, 5% note payable was issued on April 1, 2021. Interest is payable every six months on April 1 and October 1 each year. The principal is payable at maturity.

6. Salaries accrued to December 31, 2021, were $915.

7. On December 31, 2021, the company had provided services of $2,000 but had not billed or recorded the service revenue of $2,000.

8. The telephone bill for December 2021 was $210. It has not been recorded or paid. (Use the Accounts Payable account.)

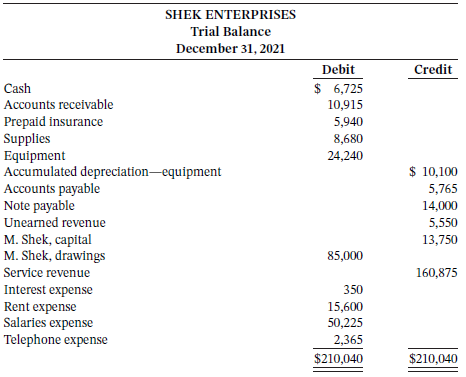

The following trial balance was prepared before adjustments:

Instructions

a. Prepare adjusting journal entries for the year ended December 31, 2021, as required.

b. Prepare an adjusted trial balance at December 31, 2021.

c. Prepare an income statement and a statement of owner?s equity for the year ended December 31, 2021, and a balance sheet at December 31, 2021.

Comment on the company?s results of operations and its financial position. In your analysis, refer to specific items in the financial statements.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak