Stoll Co.s long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters

Question:

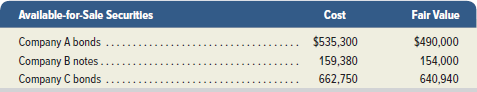

Stoll Co.’s long-term available-for-sale portfolio at the start of this year consists of the following.

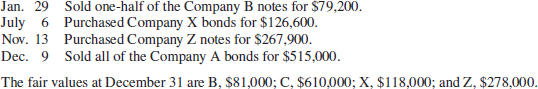

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

The fair values at December 31 are B, $81,000; C, $610,000; X, $118,000; and Z, $278,000.

Required

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair valueadjustment for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-salesecurities.

3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stollreport on its income statement for this year?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: