Using the information in Problem 4-6B, prepare an income statement and a statement of changes in equity

Question:

Using the information in Problem 4-6B, prepare an income statement and a statement of changes in equity for the year ended December 31, 2023, and a classified balance sheet at December 31, 2023. The owner made no additional investments during the year. A $2,500 payment on the long-term notes payable will be made during 2024. Also, $1,500 of the notes receivable will be collected by December 31, 2024.

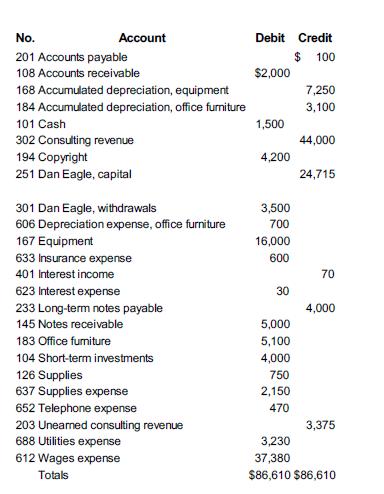

Data From Problem 4-6B

Bullseye Market Research Company (BMRC) specializes in conducting focus groups for businesses launching a new product. BMRC analyzes customer likes and dislikes to ensure new products will be successful.

You are the accounting manager. Your staff submitted the above trial balance for December 31, 2023. In your review, you discover the following additional information that has not been included in the trial balance.

1. The equipment has an estimated useful life of 16 years. If you need to create a new account, use account number 604.

2. Employees were paid $3,100 for 10 days of work. This payroll included 2 days of payroll in December that were not recorded at year-end. If you need to add an account, use account number 202.

3. On December 31, BMRC completed a focus group for a client on handbags. An invoice was sent to the company for $5,000 due January 31, 2024.

4. On December 31, the company completed a market research report for a client. The client had prepaid $3,000 for this service in November.

Required

1. Prepare the missing adjusting entries for transactions a–d.

2. Prepare an adjusted trial balance.

3. Based on your adjusted trial balance, prepare the closing entries.

Analysis Component:

Bullseye Market Research Company’s equity increased by $2,390 during 2023. What effect does an increase in equity have on the other major components of the balance sheet?

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris