Refer to information in Exercises 19-6 and 19-7. Set up T-accounts for each of the following accounts,

Question:

Refer to information in Exercises 19-6 and 19-7. Set up T-accounts for each of the following accounts, each of which started the month with a zero balance: Raw Materials Inventory, Work in Process Inventory, Finished Goods Inventory, Factory Overhead, Cost of Goods Sold. Then post entries for transactions a through g to the T-accounts and determine the balance of each account.

Data From Exercise 19.6

Information on Kwon Mfg.’s activities for its first month of operations follows.

a. Purchased $100,000 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201 .................................................... $48,200

Job 202 .................................................... 23,600

Total direct materials ........................... 71,800

Indirect materials ................................. 8,620

Total materials used.............................. $80,420

c. Time tickets show the following labor used for the month.

Job 201 .................................................... $39,200

Job 202 .................................................... 12,600

Total direct labor ................................... 51,800

Indirect labor 2....................................... 4,200

Total labor used .................................... $76,000

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $163,760 on credit.

g. Incurred the following actual other overhead costs for the month.

Depreciation of factory equipment ........ $32,000

Rent on factory building (payable) ........ 500

Factory utilities (payable) ........................ 800

Expired factory insurance ........................ 3,000

Total other factory overhead cost........ s $36,300

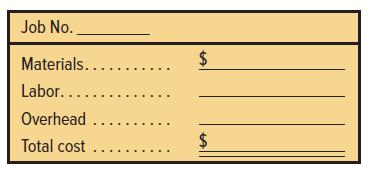

1. Prepare a job cost sheet for Job 201 and for Job 202 for the month. Use the following simplified form.

2. Compute gross profit on the sale of Job 201.

Step by Step Answer: