On December 31, 2015, Alan and Company prepared an income statement and balance sheet but failed to

Question:

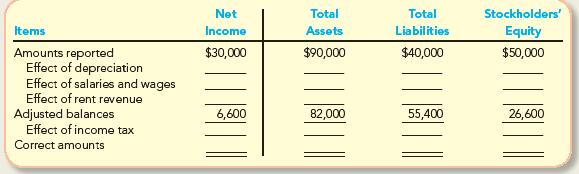

On December 31, 2015, Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income before income tax of $30,000. The balance sheet (before the effect of income taxes) reflected total assets, $90,000; total liabilities, $40,000; and stockholders’ equity, $50,000. The data for the four adjusting journal entries follow:

a. Amortization of $8,000 for the year on software was not recorded.

b. Salaries and wages amounting to $17,000 for the last three days of December 2015 were not paid and not recorded (the next payroll will be on January 10, 2016).

c. Rent revenue of $4,800 was collected on December 1, 2015, for office space for the three-month period December 1, 2015, to February 28, 2016. The $4,800 was credited in full to Unearned Revenue when collected.

d. Income taxes were not recorded. The income tax rate for the company is 30%.

Required:

Complete the following table to show the effects of the four adjusting journal entries (indicate deductions with parentheses):

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby