Asset W has an expected return of 12.8 percent and a beta of 1.25. If the risk-free

Question:

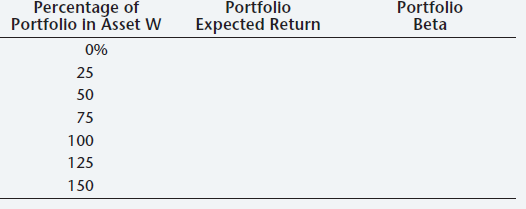

Asset W has an expected return of 12.8 percent and a beta of 1.25. If the risk-free rate is 4.1 percent,

complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected

return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results?

Transcribed Image Text:

Percentage of Portfolio Expected Return Portfolio Beta Portfolio in Ăsset W 0% 25 50 75 100 125 150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

First we need to find the b of the portfolio The b of the riskfree asset is zero and the weight of t...View the full answer

Answered By

Mary Njunu

I posses Vast, diversified knowledge and excellent grammar as a result of working in ACADEMIC WRITING for more than 5 years. I deliver work in various disciplines with assurance of quality work. I purpose at meeting the clients’ expectations precisely. Let’s work together for the best and phenomenal grades.

4.90+

928+ Reviews

2551+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted:

Students also viewed these Business questions

-

Judson Inc. recently issued new securities to finance a new TV show. The project cost $14 million, and the company paid $725,000 in flotation costs. In addition, the equity issued had a flotation...

-

Nicolet Real Estate Company was founded 25 years ago by the current CEO, Steven Nicolet. The company purchases real estate, including land and buildings, and rents the property to tenants. The...

-

You own 1000 shares of stock in Armstrong Corporation. You will receive a $1.85 per share dividend in one year. In two years, Armstrong will pay a liquidating dividend of $58 per share. The required...

-

Explain fully the role played by unplanned investment in inventories in determining equilibrium in the Keynesian model. Use the examples of AD > GDP and AD < GDP to illustrate your answer.

-

Is the cost of disposing of hazardous waste materials resulting from factory operations a product cost or a period cost? Explain.

-

Identify the coordinates of any local and absolute extreme points and inflection points. Graph the function. y = x( X 2 5 4

-

An asset has the estimated salvage values for various lives, shown in the table below. For each possible life from 1 to 6 by 1, determine the capital recovery cost for MARR of 8 percent/year. EOY NCF...

-

Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow compute the following liquidity measures for 20-2 (round all calculations to two decimal...

-

1. Consider 3 a. Draw a tape diagram that represents 3. I b. Use the tape diagram from part (a) to evaluate 3+

-

Four different paints are advertised as having the same drying time. To check the manufacturers claims, five samples were tested for each of the paints. The time in minutes until the paint was dry...

-

You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 12 percent and Stock Y with an expected return of 9.5 percent. If your goal is to create a...

-

You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fill in the rest of the following table: Asset Stock A Stock B Stock C...

-

The table below shows the closing monthly stock prices for IBM and Amazon. Calculate the simple three-month moving average for each month for both companies. IBM AMZN...

-

The system below is a leadscrew-driven stage that positions a mass. It has the following properties: input voltage 24 V 20 kg load mass screw length 500 mm motor model Electrocraft RPX2242V24 screw...

-

A level was setup between BM A and TP1. The upper, middle, and lower cross hair readings on BM A was .718, .633, and .550 meters. The upper, middle, and lower cross hair readings on TP1 was 1.131,...

-

For an emergency operation theatre in a hospital, the power is obtained from the main city supply through a transformer connected in series. To ensure an uninterrupted supply, an auxiliary generator...

-

Which one of the following is the permanent mould casting process? ( A ) Investment casting process ( B ) Full mould process ( C ) Vacuum casting process ( D ) Die casting process

-

A well insulated gas turbine of a technical power of 110 kW uses air (0.5kg/s) as working fluid at a pressure of pi = 10 bar and a temperature of 573 K expanded to atmospheric pressure. Calculate the...

-

Gena exchanges land held as an investment with a $60,000 basis for other land with a $80,000 FMV and a motorcycle with a $10,000 FMV. The acquired land is to be held for investment and the motorcycle...

-

An example of prescriptive analytics is when an action is recommended based on previously observed actions. For example, an analysis might help determine procedures to follow when new accounts are...

-

Finding the Target Capital Structure Famas LIamas has a weighted average cost of capital of 10.2 percent. The companys cost of equity is 14 percent, and its pretax cost of debt is 8.4 percent. The...

-

Value of a Right show that the value of a right just prior to expiration can be written as: Value of right = PRO Px = (PRO PS) / (N + 1) where PRO, PS and Px stand for the rights-on-price, the...

-

Selling Rights Atlas Corp wants to raise $4.1 million via a rights offering. The company currently has 490,000 shares of common stock outstanding that sell for share. Its underwriter has set a...

-

For this assignment, submit the code (SQL script or document), including structure from the Data Definition Language (DDL) and the Data Manipulation Language (DML). Use these SQL Statements as a...

-

Data Manipulation Tasks a Insert 20 records into each table for testing purposes. a Delete an entire order by using the unique identifier for that order. o Update the price of a product by using the...

-

Data manipulation language (DML) provides a number of capabilities that allow you to build custom queries of existing data. What are two capabilities you might use to limit the data you select or...

Study smarter with the SolutionInn App