In the previous problem, suppose the fair market value of Essexs fixed assets is $9,300 versus the

Question:

In the previous problem, suppose the fair market value of Essex’s fixed assets is $9,300 versus the $6,400 book value shown. Amherst pays $16,000 for Essex and raises the needed funds through an issue of long-term debt. Construct the post-merger statement of financial position now, assuming that the purchase method of accounting is used.

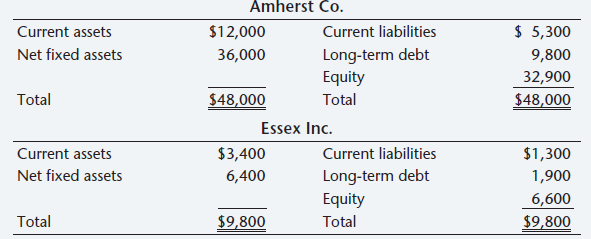

Data from previous problem

Assume that the following statements of financial position are stated and a book value. Construct a post-merger statement of financial position assuming that Amherst Co. purchases Essex Inc. and the pooling of interests method of accounting is used.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted: