Management of Larsen Automotive, a manufacturer of auto parts, is considering investing in two projects. The company

Question:

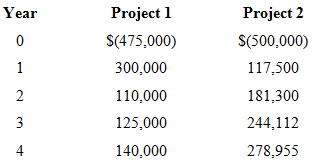

Management of Larsen Automotive, a manufacturer of auto parts, is considering investing in two projects. The company typically compares project returns to a cost of funds of 17 percent. Compute the IRRs based on the cash flows in the following table. Which project(s) will be accepted?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Question Posted: