Munson Communications Company management has just reported earnings for the year ended June 30, 2017. Below are

Question:

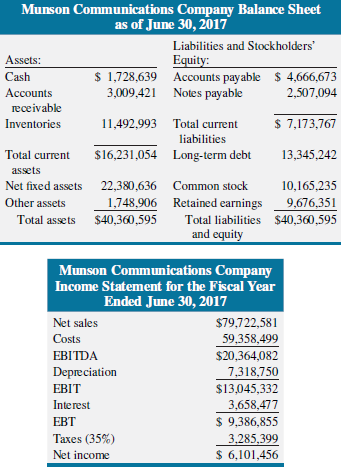

Munson Communications Company management has just reported earnings for the year ended June 30, 2017. Below are the firm’s income statement and balance sheet. The company had a 55 percent dividend payout ratio for the last 10 years and management does not plan to change this policy. Based on internal forecasts, management expects sales growth in 2018 to be 20 percent. Assume that equity accounts and long-term debt do not vary directly with sales but change when retained earnings change or additional capital is issued.

a. What is the firm’s internal growth rate (IGR)?

b. What is the firm’s sustainable growth rate (SGR)?

c. What is the external funding needed (EFN) to accommodate the expected growth?

d. Construct the firm’s 2018 pro forma financial statements under the assumption that long-term debt will provide all external funding.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Internal Growth Rate

"An internal growth rate (IGR) is the highest level of growth achievable for a business without obtaining outside financing, and a firm's maximum internal growth rate is the level of business operations that can continue to fund and grow the...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates