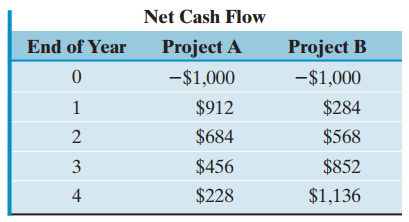

Consider the following two mutually exclusive projects: (a) At an interest rate of 25%, which project would

Question:

(a) At an interest rate of 25%, which project would you recommend choosing?

(b) Compute the area of negative project balance, discounted payback period, and area of positive project balance for each project. Which project is exposed to a higher risk of loss if either project terminates at the end of year 2?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: