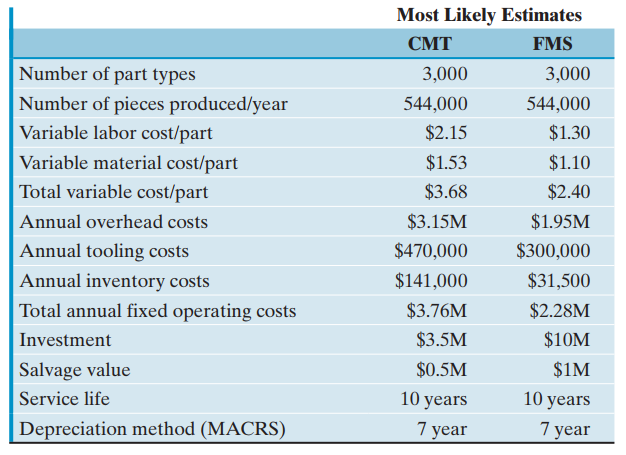

The following is a comparison of the cost structure of a conventional manufacturing technology (CMT) system with

Question:

(a) The firm€™s marginal tax rate and MARR are 40% and 15%, respectively. Determine the incremental cash flow (FMS - CMT) based on the most likely estimates.

(b) Management feels confident about all input estimates for the CMT. However, the firm does not have any previous experience in operating an FMS. Therefore, many of the input estimates for that system, except the investment and salvage value, are subject to variation. Perform a sensitivity analysis on the project€™s data, varying the elements of the operating costs. Assume that each of these variables can deviate from its base€case expected value by ±10%, ± 20%, and ± 30 %.

(c) Prepare sensitivity diagrams and interpret the results.

(d) Suppose that probabilities of the variable material cost and the annual inventory cost for the FMS are estimated as follows:

Material Cost

Cost per Part Probability

$1.0€¦€¦€¦€¦€¦€¦€¦€¦..€¦0.25

$1.10€¦€¦€¦€¦€¦€¦€¦€¦€¦0.30

$1.20€¦€¦€¦€¦€¦€¦€¦€¦€¦0.20

$1.30€¦€¦€¦€¦€¦€¦€¦€¦€¦0.20

$1.40€¦€¦€¦€¦€¦€¦€¦€¦€¦0.05

Inventory Cost

Annual Inventory Cost Probability

$25,000€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦0.10

$31,000€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦0.30

$50,000€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦0.20

$80,000€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦0.20

$100,000€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦..0.20

What are the best and the worst cases of incremental PW?

(e) In part (d), assuming that the random variables of the cost per part and the annual inventory cost are statistically independent, find the mean and variance of the PW for the incremental cash flows.

(f) In parts (d) and (e), what is the probability that the FMS would be a more expensive investment option?

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Step by Step Answer: