Companies that operate in different industries may have very different financial ratio values. These differences may grow

Question:

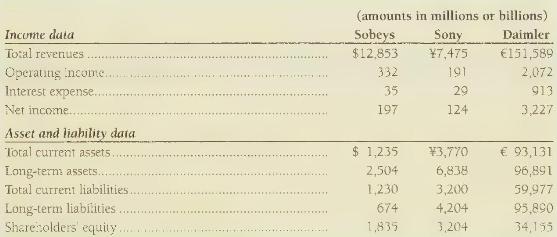

Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries Compare three leading companies on their current ratio, debt ratio, and times-interest earned ratio. Compute three ratios for Sobeys (the Canadian grocery chain), Sony (the Japanese electronics manufacturer), and Daimler (the German auto company).

Based on your computed ratio values, which company looks the least risky?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin

Question Posted: