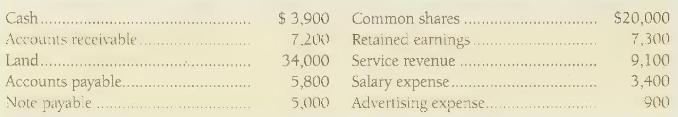

The trial balance of You Build Inc. at December 31, 2020, does not balance. {Requirements} 1. How

Question:

The trial balance of You Build Inc. at December 31, 2020, does not balance.

{Requirements}

1. How much out of balance is the trial balance? Assume the error lies in the Accounts Receivable account. What is the correct balance of Accounts Receivable?

2. You Build Inc. also failed to record the following transactions during December:

a. Purchased additional land for \(\$ 60,000\) by signing a note payable.

b. Earned service revenue on account, \(\$ 10,000\).

c. Paid salary expense of \(\$ 1,400\).

d. Purchased a TV advertisement for \(\$ 1,000\) on account. This account will be paid during January.

Add these amounts to, or subtract them from, the appropriate accounts to properly include the effects of these transactions. Then prepare the corrected trial balance of You Build Inc.

3. After correcting the accounts, advise the top management of You Build Inc. on the company's:

a. Total assets.

b. Total liabilities.

c. Net income or loss.

Analyze transactions using the accounting equation; identify accounts affected by transactions

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin