Use this problem in conjunction with Problem P2-33. {Requirements} 1. Journalize the transactions of Blythe Spirit Consulting,

Question:

Use this problem in conjunction with Problem P2-33.

{Requirements}

1. Journalize the transactions of Blythe Spirit Consulting, Inc. Explanations are not required.

2. Set up the following T-accounts: Cash, Accounts Receivable, Supplies, Land, Accounts Payable, Share Capital, Retained Earnings, Dividends, Service Revenue, Rent Expense, and Advertising Expense. Insert in each account its balance as given (example: Cash \(\$ 1,300\) ). Post the transactions to the accounts.

3. Compute the balance in each account. For each asset account, each liability account, and for Share Capital, compare its balance to the ending balance you obtained in problem 2-33 Are the amounts the same or different?

Problem P2-33

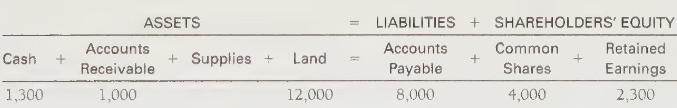

The following amounts summarize the financial position of Blythe Spirit Consulting, Inc. on May 31, 2020:

During June 2020, the business completed these transactions:

a. Received cash of \(\$ 5,000\), and issued common shares.

b. Performed services for a client, and received cash of \(\$ 7,600\).

c. Paid \(\$ 4,000\) on accounts payable.

d. Purchased supplies on account, \(\$ 1,500\)

e. Collected cash from a customer on account, \(\$ 1,000\)

f. Consulted on the design of a business report, and billed the client for services rendered, \(\$ 2,500\)

g. Recorded the following business expenses for the month: paid office rent, \(\$ 900\); paid advertising, \(\$ 300\)

h. Declared and paid a cash dividend of \(\$ 2,000\).

{Requirements}

1. Prepare the income statement of Blythe Spirit Consulting, Inc. for the month ended June 30, 2020. List expenses in decreasing order by amount.

2. Prepare the entity's statement of retained earnings for the month ended June \(30,2020\).

3. Prepare the balance sheet of Blythe Spirit Consulting, Inc. at June 30, 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin