In Problem 21, suppose the dividends per share over the same period were $1.00, $1.08, $1.17, $1.25,

Question:

Data From Problem 21

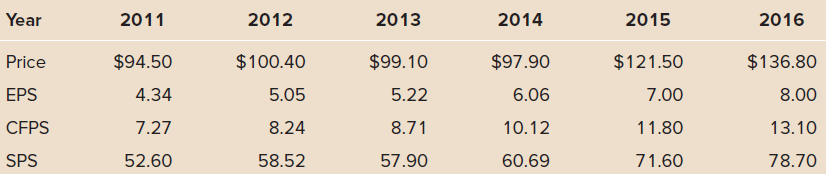

Given the information below for Seger Corporation, compute the expected share price at the end of 2017 using price ratio analysis. Assume that the historical average growth rates will remain the same for 2017.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: