A receiver was appointed by the court to manage the affairs of Davis Manufacturing Company on March

Question:

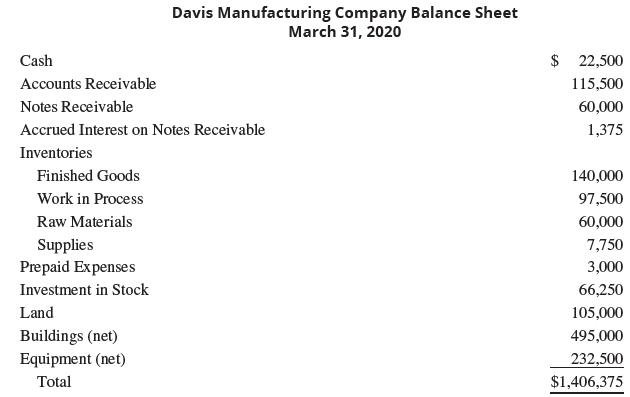

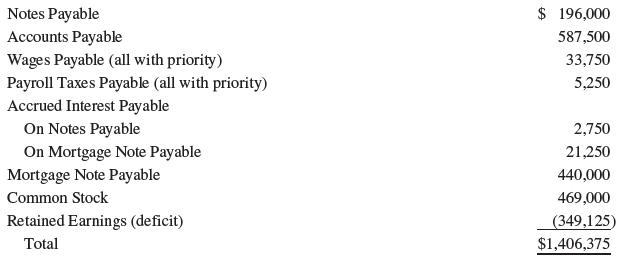

A receiver was appointed by the court to manage the affairs of Davis Manufacturing Company on March 31, 2020. On this date, the following balance sheet applied:

Additional Information:

1. The cash account includes a $500 travel advance that has been spent.

2. Of the total accounts receivable, $75,000 is believed to be collectible. The remaining accounts are doubtful, but it is believed that about one- third of these will be realized eventually. The accounts receivable are pledged as security on a $10,000 note payable.

3. Notes receivable of $50,000 have been pledged as security on a note payable of $45,000. This portion of the notes receivable has an estimated realizable value of $35,000. The remaining notes receivable, including the accrued interest, are expected to be fully collected. The $45,000 note payable has accrued interest due of $1,000.

4. The finished- goods inventory is expected to sell at 20% above its cost, with expenses involved in its disposition approximating 10% of selling price. The work in process inventory can be completed at an additional cost of $55,000, of which $40,000 represents materials used

from the present raw materials inventory. The completed work in process should then sell for $145,000; the remaining raw materials should sell for one- half their cost. Supplies are expected to realize $1,300.

5. The investment in stock consists of 2,000 shares of Monelli Vineyards. The stock has a current market value of $50 per share and is pledged as security on a note payable of $41,000. Interest accrued on the note payable amounts to $1,750.

6. The land and buildings have been appraised at $165,000 and $260,000, respectively. They are pledged as collateral on the mortgage note payable.

7. The equipment is expected to realize $100,000.

8. Prepaid expenses are nonrealizable.

Required:

A. Prepare a statement of affairs.

B. Prepare a deficiency account detailing estimated gains and losses.

C. Calculate the dividend rate per dollar of unsecured liabilities.

Step by Step Answer: