Gemini manufactures athletic shoes. The company records manufacturing costs by job number and uses a factory overhead

Question:

Gemini manufactures athletic shoes. The company records manufacturing costs by job number and uses a factory overhead applied rate to charge overhead costs to its products.

The company estimates Gemini will manufacture 50,000 shoes next year. For this amount of production, total factory overhead is estimated to be $398,800.00. Estimated direct labor costs for next year are $498,500.00.

Instructions:

1. Calculate Gemini’s factory overhead applied rate for next year as a percentage of direct labor cost.

On May 3, Gemini began work on Job No. 283. The order is for 150 pairs of No. 52L athletic shoes for stock;

date wanted May 13.

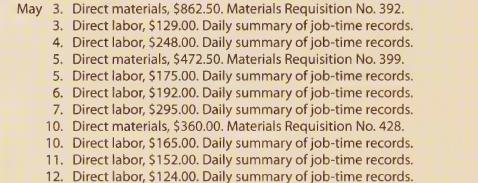

2. Open a cost sheet for Job No. 283 and record the following items.

3. Complete the cost sheet, recording factory overhead at the rate calculated in Instruction 1.

4. Prepare a finished goods ledger card for Stock No. 52L athletic shoes. Minimum quantity is set at 100. Inventory location is Area C-50.

5. Record on the finished goods ledger card the beginning balance on May 1. The May 1 balance of 52L athletic shoes is 140 units at a unit cost of $30.45. Gemini uses the first-in, first-out method to record inventory costs.

6. Record the following transactions on the finished goods ledger card for 52L athletic shoes.

![]()

Step by Step Answer: