On January 1, 2011, Stamford issues 10,000 additional shares of common stock for ($15) per share. Neill

Question:

On January 1, 2011, Stamford issues 10,000 additional shares of common stock for \($15\) per share.

Neill does not acquire any of this newly issued stock. How does this transaction affect the parent company’s Additional Paid-In Capital account?

a. Has no effect on it.

b. Increases it by \($44,000\).

c. Decreases it by \($35,200\).

d. Decreases it by \($55,000\).

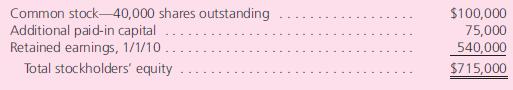

Neill Company purchases 80 percent of the common stock of Stamford Company on January 1, 2010, when Stamford has the following stockholders’ equity accounts:

To acquire this interest in Stamford, Neill pays a total of \($592,000.\) The acquisition-date fair value of the 20 percent noncontrolling interest was \($148,000.\) Any excess fair value was allocated to goodwill, which has not experienced any impairment.

On January 1, 2011, Stamford reports retained earnings of \($620,000\). Neill has accrued the increase in Stamford’s retained earnings through application of the equity method.

View the following problems as independent situations:

Step by Step Answer: