On January 1, 2024, Palmer Company acquired a 90% interest in Stevens Company at a cost of

Question:

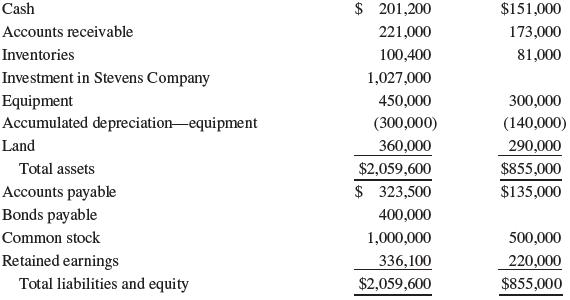

On January 1, 2024, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company’s stockholders’ equity consisted of the following:

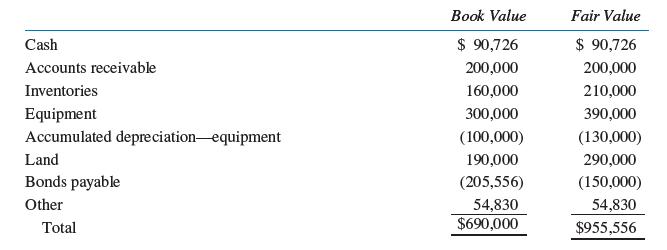

An examination of Stevens Company’s assets and liabilities revealed the following at the date of acquisition:

Additional Information— Date of Acquisition

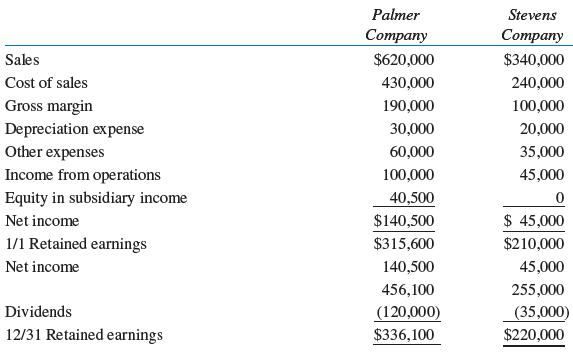

Stevens Company’s equipment had an original life of 15 years and a remaining useful life of 10 years. All the inventory was sold in 2024. Stevens Company purchased its bonds payable on the open market on January 10, 2024, for $150,000 and recognized a gain of $55,556. Palmer Company uses the partial equity method to record its investment in Stevens Company. Financial statement data for 2026 are presented here:

Required:

A. Prepare in general journal form the workpaper entry to allocate and depreciate the difference between book value and the value implied by the purchase price in the December 31, 2024, consolidated statements workpaper.

B. Prepare a consolidated financial statements workpaper for the year ended December 31, 2026.

C. Prepare in good form a schedule or t- account showing the calculation of the controlling interest in consolidated net income for the year ended December 31, 2026.

Step by Step Answer: