On January 1, 2025, Pruitt Company issued 25,500 shares of its common stock ($2 par) in exchange

Question:

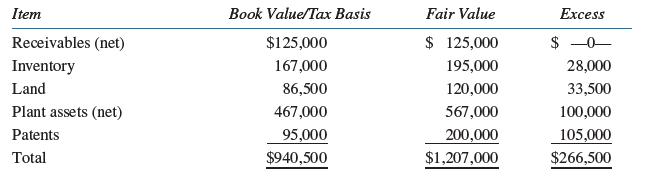

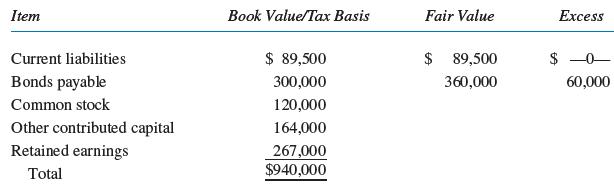

On January 1, 2025, Pruitt Company issued 25,500 shares of its common stock ($2 par) in exchange for 85% of the outstanding common stock of Shah Company. Pruitt’s common stock had a fair value of $28 per share at that time. Pruitt Company uses the cost method to account for its investment in Shah Company and files a consolidated income tax return. A schedule of the Shah Company assets acquired and liabilities assumed at book values (which are equal to their tax bases) and fair values follows.

Additional Information:

1. Pruitt’s income tax rate is 35%.

2. Shah’s beginning inventory was all sold during 2025.

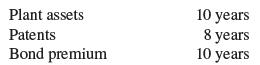

3. Useful lives for depreciation and amortization purposes are:

4. Pruitt uses the straight- line method for all depreciation and amortization purposes.

Required:

A. Prepare the stock acquisition entry on Pruitt Company’s books.

B. Assuming Shah Company earned $216,000 and declared a $90,000 dividend during 2025, prepare the eliminating entries for a consolidated statements workpaper on December 31, 2025.

C. Assuming Shah Company earned $240,000 and declared a $100,000 dividend during 2026, prepare the eliminating entries for a consolidated statements workpaper on December 31, 2026.

Step by Step Answer: