Select the best answer for each of the following items: 1. Golf Company acquired 80% of the

Question:

Select the best answer for each of the following items:

1. Golf Company acquired 80% of the outstanding stock of Ping Company, a foreign company, in an acquisition accounted for as a purchase transaction. In preparing consolidated statements, the paid- in capital of Ping Company should be translated into dollars at the

(a) Current exchange rate in effect at the balance sheet date.

(b) Exchange rate in effect at the date the capital transactions of the subsidiary took place.

(c) Exchange rate in effect at the date Golf Company purchased the Ping Company stock.

(d) Exchange rate effective when Ping Company was organized.

2. The account balances of a foreign entity are required by SFAS No. 52 to be measured using that entity’s functional currency. The functional currency of an entity is defined as

(a) The currency in which the entity’s transactions are recorded.

(b) The currency of the primary economic environment in which the entity operates.

(c) The U.S. dollar.

(d) The local currency of the country in which the entity is physically located.

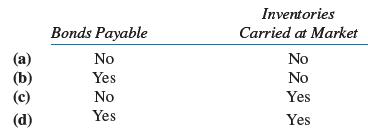

3. When translating foreign currency financial statements for an entity whose functional currency is the local currency of the country in which it is physically located, which of the following accounts is translated using current exchange rates?

4. A translation adjustment (or translation gain) that is a consequence of translation of a functional currency that is different from the reporting currency should be

(a) Deferred and amortized over a period not to exceed 40 years.

(b) Deferred until a subsequent year when a loss occurs and offset it against that loss.

(c) Included as a separate item in the equity section of the balance sheet.

(d) Included in net income in the period in which it occurs.

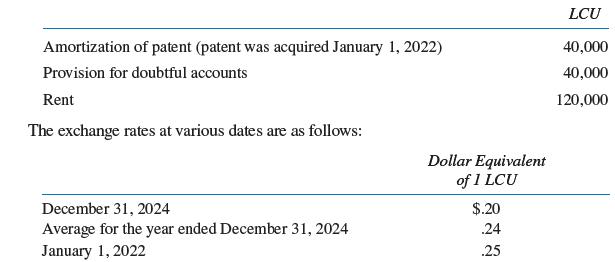

5. A wholly owned foreign subsidiary of Import Corporation has certain expense accounts for the year ended December 31, 2024, stated in local currency units (LCU) as follows:

The subsidiary’s operations were an extension of the parent company’s operations. What total dollar amount should be included in Import’s income statement to reflect the foregoing expenses for the year ended December 31, 2024?

(a) $48,000.

(b) $40,000.

(c) $48,400.

(d) $42,000.

Step by Step Answer: