The insurance company called Cetera is facing the following problem: Whenever there is a major event (e.g.,

Question:

The insurance company called Cetera is facing the following problem: Whenever there is a major event (e.g., a storm), their claim-to-resolution process is unable to cope with the ensuing spike in demand. During normal times, the insurance company receives about 9,000 calls per week, but during a storm scenario the number of calls per week doubles.

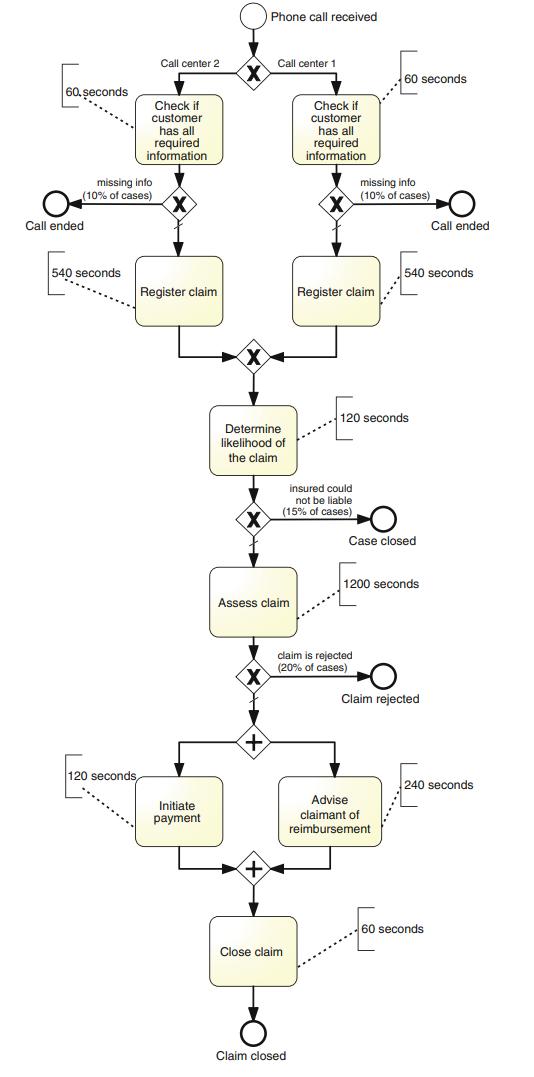

The claim-to-resolution process model of Cetera is presented in Figure 7.15. The process starts when a call related to lodging a claim is received. The call is routed to one of two call centers depending on the location of the caller. Each call center receives approximately the same amount of calls (50–50) and has the same number of operators (40 per call center). The process for handling calls is identical across both call centers. When a call is received at a call center, the call is picked up by a call center operator. The call center operator starts by asking a standard set of questions to the customer to determine if the customer has the minimum information required to lodge a claim (e.g., insurance policy number). If the customer has enough information, the operator then goes through a questionnaire with the customer, enters all relevant details, checks the completeness of the claim, and registers the claim.

Figure 7.15

Once a claim has been registered, it is routed to the claims handling office, where all remaining steps are performed. There is one single claims handling office, so regardless of the call center agent where the claim is registered, the claim is routed to the same office. In this office, the claim goes through a two-stage evaluation process. First of all, the liability of the customer is determined. Secondly, the claim is assessed in order to determine if the insurance company has to cover this liability and to what extent. If the claim is accepted, payment is initiated and the customer is advised of the amount to be paid. The tasks of the claims handling department are performed by claims handlers. There are 150 claims handlers in total. The mean cycle time of each task (in seconds) is indicated in Figure 7.15. For every task, the cycle time follows an exponential distribution. The hourly cost of a call center agent is ϵ 30, while the hourly cost of a claims handler is ϵ 50. Describe the input that should be given to a simulator in order to simulate this process in the normal scenario and in the storm scenario. Using a simulation tool, encode the normal and the storm scenarios, and run a simulation in order to compare these two scenarios.

Step by Step Answer:

Fundamentals Of Business Process Management

ISBN: 9783662565087

2nd Edition

Authors: Marlon Dumas, Marcello La Rosa, Jan Mendling, Hajo A. Reijers