Question:

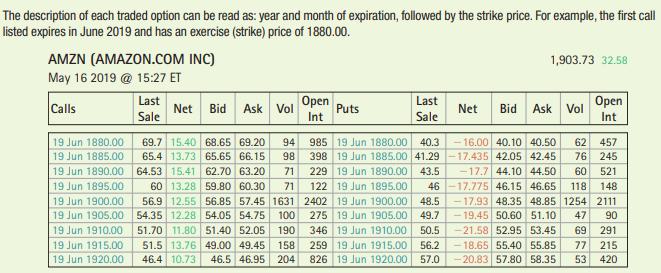

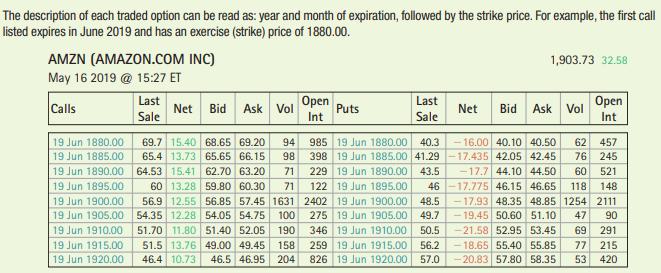

PLAN From Table 21.2, the ask price of this option is $54.75. Remember that the price quoted is per share and that each contract is for 100 shares.

EXECUTE You are purchasing 10 contracts and each contract is on 100 shares, so the transaction will cost 54.75 * 10 * 100 = $54,750 (ignoring any commission fees). Because this is a call option and the exercise price is above the current stock price ($1,903.73), the option is currently out-of-the-money.

EVALUATE Even though the option is currently out-of-the-money, it still has value. During the time left to expiration, the stock could rise above the exercise (strike) price of $1905.

Table 21.2:

Transcribed Image Text:

The description of each traded option can be read as: year and month of expiration, followed by the strike price. For example, the first call listed expires in June 2019 and has an exercise (strike) price of 1880.00. AMZN (AMAZON.COM INC) May 16 2019 @ 15:27 ET Calls Last Sale Net Bid Ask Vol 19 Jun 1880.00 69.7 15.40 68.65 69.20 19 Jun 1885.00. 65.4 13.73 65.65 66.15 19 Jun 1890.00 64.53 15.41 62.70 63.20 19 Jun 1895.00 19 Jun 1900.00 19 Jun 1905.00 19 Jun 1910.00 19 Jun 1915.00 19 Jun 1920.00 Open Int Puts Last Sale 94 985 98 398 71 229 60 13.28 59.80 60.30 71 122 56.9 12.55 56.85 57.45 1631 2402 54.35 12.28 54.05 54.75 100 275 51.70 11.80 51.40 52.05 190 346 51.5 13.76 49.00 49.45 158 259 19 Jun 1915.00 46.4 10.73 46.5 46.95 204 826 19 Jun 1920.00 19 Jun 1880.00 40.3 19 Jun 1885.00 41.29 19 Jun 1890.00 43.5 19 Jun 1895.00 46 19 Jun 1900.00 48.5 49.7 50.5 56.2 57.0 19 Jun 1905.00 19 Jun 1910.00 1,903.73 32.58 Net Bid Ask Vol Open Int 16.00 40.10 40.50 62 457 -17.435 42.05 42.45 76 245 -17.7 44.10 44.50 60 521 -17.775 46.15 46.65 118 148 -17.93 48.35 48.85 1254 2111 -19.45 50.60 51.10 47 90 -21.58 52.95 53.45 69 291 -18.65 55.40 55.85 77 215 -20.83 57.80 58.35 53 420