A firm has been experiencing low profitability in recent years. Perform an analysis of the firms financial

Question:

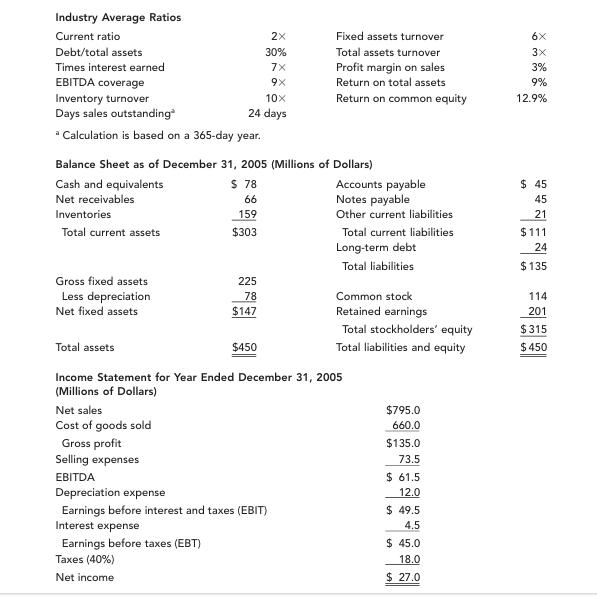

A firm has been experiencing low profitability in recent years. Perform an analysis of the firm’s financial position using the extended Du Pont equation. The firm has no lease payments, but has a $2 million sinking fund payment on its debt. The most recent industry average ratios and the firm’s financial statements are as follows:  a. Calculate those ratios that you think would be useful in this analysis.

a. Calculate those ratios that you think would be useful in this analysis.

b. Construct an extended Du Pont equation, and compare the company’s ratios to the industry average ratios.

c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits?

d. Which specific accounts seem to be most out of line relative to other firms in the industry?

e. If the firm had a pronounced seasonal sales pattern, or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you cor rect for such potential problems?

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9781111795207

11th Edition

Authors: Richard Bulliet, Eugene F Brigham, Brigham/ Houston