As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The purchase price

Question:

As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The purchase price of the equipment, including installation, is $65,000, and the equipment will be fully depreciated at t = 0. Annual sales would be 4,000 units at a price of $50 per cartridge, and the project’s life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At the end of 3 years, the equipment could be sold for $10,000. Variable costs would be 70% of sales revenues, fixed costs would be $30,000 per year, the marginal tax rate is 25%, and the corporate WACC is 11%.

a. What is the required investment after bonus depreciation is considered, that is, the Year 0 project cash flow?

b. What are the project’s annual cash flows?

c. If the project is of average risk, what is its NPV? Should it be accepted?

d. Management is uncertain about the exact unit sales. What would the project’s NPV be if unit sales turned out to be 20% below forecast, but other inputs were as forecasted?

Would this change the decision? Explain.

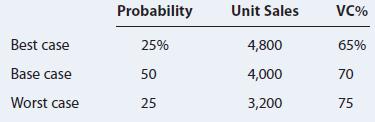

e. The CFO asks you to do a scenario analysis using these inputs:

Other variables are unchanged. What are the expected NPV, its standard deviation, and the coefficient of variation? (Hint: To do the scenario analysis, you must change unit sales and VC% to the values specified for each scenario, get the scenario cash flows, and then find each scenario’s NPV. Then you must calculate the project’s expected NPV, standard deviation [s], and coefficient of variation [CV]. This is not difficult, but it would require a lot of calculations. You might want to look at the answer in Appendix A at the back of the text, but make sure you understand how it was calculated.)

f. The firm’s project CVs generally range from 1.0 to 1.5. A 3% risk premium is added to the WACC if the initial CV exceeds 1.5, and the WACC is reduced by 0.5% if the CV is 0.75 or less. Then a revised NPV is calculated. What WACC should be used for this project when project risk has been properly considered? What are the revised values for the NPV, standard deviation, and coefficient of variation? Would you recommend that the project be accepted? Why or why not?

ST-3 PROJECTS WITH UNEqUAL LIVES Wisconsin Dairy Inc. is deciding on its capital budget for the upcoming year. Among the projects being considered are two machines, W and WW. W has an after-tax cost of $500,000 and will produce expected after-tax cash flows of $300,000 during the next 2 years. WW also has an after-tax cost of $500,000, but it will produce aftertax cash flows of $165,000 during the next 4 years. Both projects have a 10% WACC.

a. If the projects are independent and not repeatable, which project or projects should the company accept?

b. If the projects are mutually exclusive but are not repeatable, which project should the company accept?

c. Assume that the projects are mutually exclusive and can be repeated indefinitely. 1. Use the replacement chain method to determine the NPV of the project selected. 2. Use the equivalent annual annuity method to determine the annuity of the project selected.

d. Could a replacement chain analysis be modified for use where the project’s cash flows are different each time it is repeated? Explain.

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston