Edmonds Industries is forecasting the following income statement: The CEO would like to see higher sales and

Question:

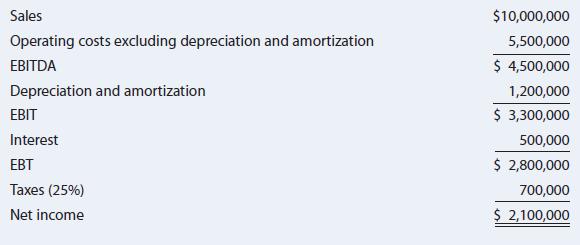

Edmonds Industries is forecasting the following income statement:

The CEO would like to see higher sales and a forecasted net income of $3,000,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 6%. The tax rate, which is 25%, will remain the same. (Note that while the tax rate remains constant, the taxes paid will change.) What level of sales would generate $3,000,000 in net income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: