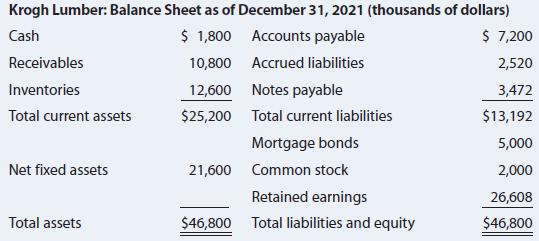

Krogh Lumbers 2021 financial statements are shown here. a. Assume that the company was operating at full

Question:

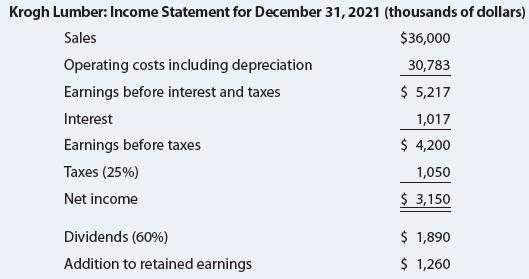

Krogh Lumber’s 2021 financial statements are shown here.

a. Assume that the company was operating at full capacity in 2021 with regard to all items except fixed assets; fixed assets in 2021 were being utilized to only 75% of capacity.

By what percentage could 2022 sales increase over 2021 sales without the need for an increase in fixed assets?

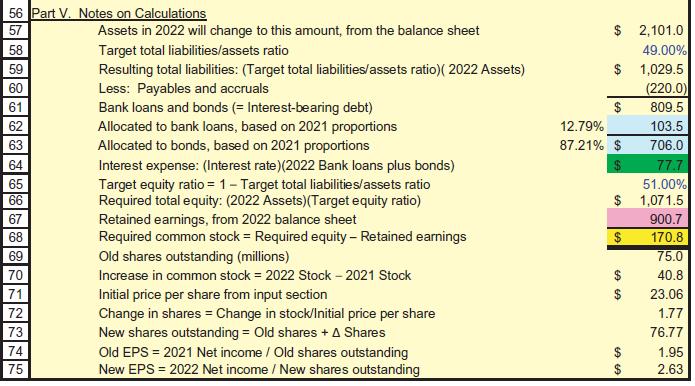

b. Now suppose 2022 sales increase by 25% over 2021 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%.

The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2022 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firm’s current stock price of $40.

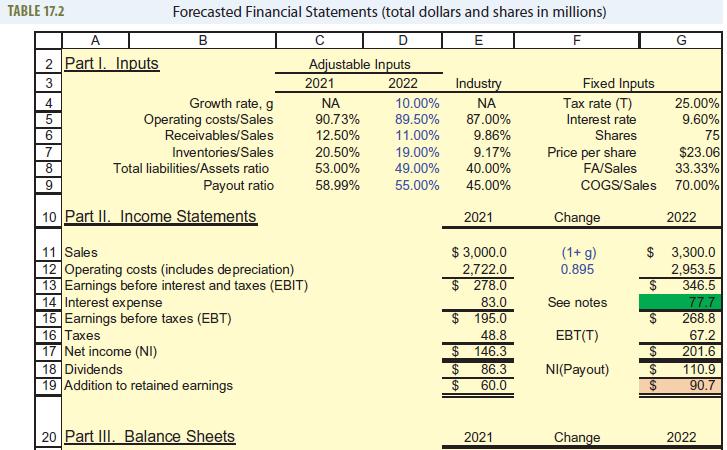

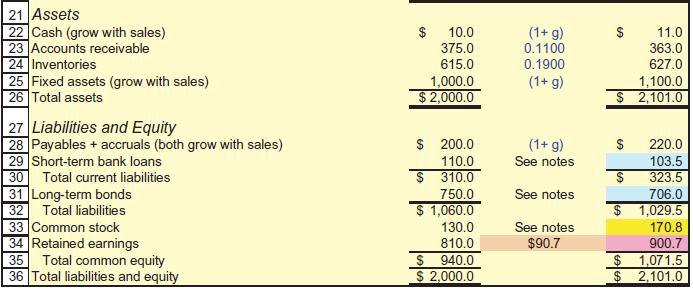

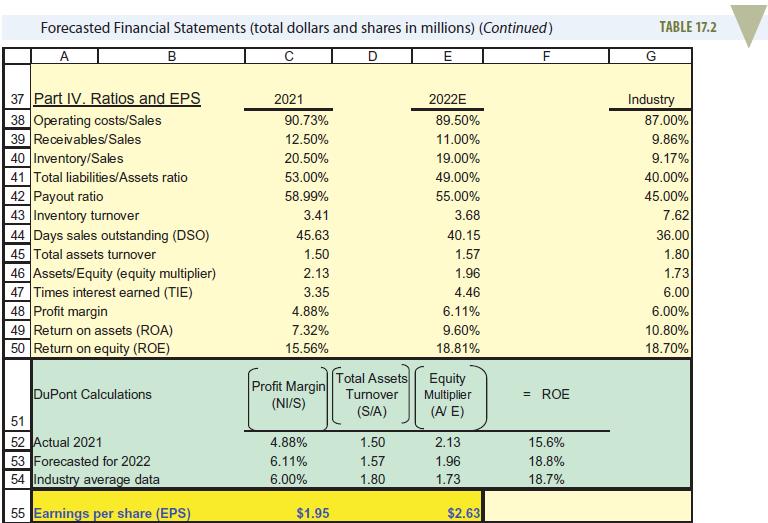

Develop Krogh’s projected financial statements like those shown in Table 17.2. What are the balances of notes payable, bonds, common stock, and retained earnings

Table 17.2

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston